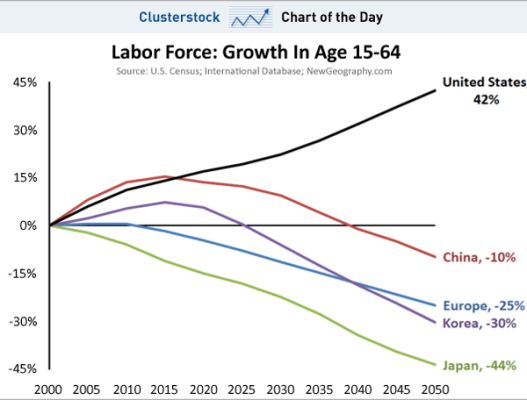

Talk about the future of Chinese retirees, as I mentioned previously, I read a report that painted a bleak picture. Their demographics are worse than ours, though I do not remember the specifics. Remember the Chinese government's "one-child" policy to control population growth? The off-shoot of that policy is that there will be fewer workers to support the current parents with only one child. And now that the Chinese living condition is getting better, I would venture that their longevity will also lengthen.

Too many geezers, all around the world! Many developed countries will have a higher ratio of retirees to workers than that of the US. Japan is one such example. Bleak, bleak...

When there are fewer workers to support people who are no longer producing, there have to be shortages of services and goods. Of course, the geezers can "help" by cutting back on consumption. This reduction on consumption is most likely to be involuntary. The retirees who have less, either because they failed to save or did not have high income to allow them to save, will feel crimped. Collectively, even if everybody is a good saver, we still have a problem. When there are too many dollars chasing too few good and services because there are fewer workers, there will always be people at the bottom 10% who get squeezed.

It's a tough problem. Bleak, bleak, bleak...