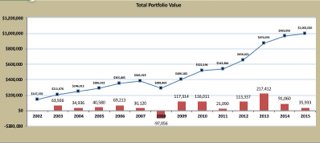

This is an update to include the loss at the bottom of the benchmarks. As can be expected, the higher the stock AA, the deeper the loss, the longer the recovery.

VFIAX (100% stock): 5 years, loss -55%

VWENX (60% stock): 3 years, loss -35%

VWIAX (40% stock): 2 years, loss -20%

Me (variable, 40% to 80% stock): 3 years, loss -37%

Considering that I was having a small net withdrawal, plus an initial high stock AA, I didn't do too badly.

If one looks at the stock market shape around the deep notch on 3/2009, one will see that it is a deep V shape, with broad shoulders. The S&P peaked out 16 months before that notch. Then, when it recovered, it was skimming the break-even line for several months before encroaching it.

So, if one was in an accumulating phase, fresh money invested would push his peak portfolio a lot closer to the notch, then pull it in a lot sooner during the recovery. And if one is in the withdrawal phase, his entire curve is slanted downward, and the two even points will stretch out to many more years. All that is evident in the results that posters reported.

When the next big drop comes, I will be fully in withdrawal phase and it will take a lot longer to see that money coming back, if at all. And it is going to be much more painful to throw money at the stocks that keep sinking into an apparent abyss.

It ain't easy.