I neither said nor implied head in the sand.Yep, the 'head in the sand' approach is always a good one.I think Midpacks suggestion has a lot of merit, and the information appears to be factual, not just trumped up for excitement like so many news items.

-ERD50

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Interesting Federal Income Tax Info

- Thread starter mickeyd

- Start date

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

What about the 48% that's claimed to pay no federal income tax? I would think that that would cover at least everyone making under $30K/year.

If you're comparing to the chart in the OP, note that it includes Medicare and SS taxes. Your 48% applies only to federal income tax.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't think your single son is a good example. I think of low income families with dependents and mortgages (often exceeds standard deduction).Not so. If you have tax software try creating a return for a single person earning under $30k. A quick look back at my young son's tax returns and in 2009 he earned ~$28k and paid $2.5k in Fed Income tax.

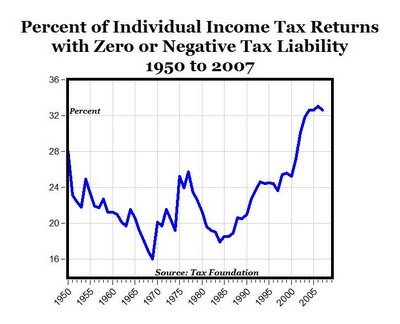

I've heard the 47% pay no FIT, so I had to look further.

And note the number who pay no FIT has increased dramatically since the recent recession (I did not find a chart that went past 2007, but we know what the current numbers are).

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy PrioritiesYet the vast majority of the people who owe no federal income taxes fall into one of three categories (see Figure 4):

- Approximately 61 percent are working people who pay payroll taxes. As noted above, even the low-income households in this group pay substantial federal income taxes over time. The main options to force these people to pay federal income tax in years when their incomes are low include cutting the EITC or the Child Tax Credit, which would tend to reduce work incentives and increase child poverty and welfare use, and lowering the standard deduction or personal exemption, which could tax many low-income working families into, or deeper into, poverty.

- An additional 22 percent of people who did not pay federal income taxes in 2009 are people aged 65 or older who have modest incomes (and do not have earnings). The main option to make these individuals pay federal income tax would be to subject their Social Security benefits to taxation despite their limited income.

- The remaining 17 percent includes students, people with disabilities or illnesses, the long-term unemployed, and other people with very low taxable incomes. To make these people pay federal income taxes, policymakers would have to tax disability, veterans’, and similar benefits or make full-time students and the long-term jobless individuals borrow (or draw from any available savings) to pay taxes on their meager incomes.

Attachments

Last edited:

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

CBS Sunday Morning had a story on tax cheating this morning. They said only 85% of taxes due are paid and that collecting the other 15% would help reduce the deficit. So far so good.

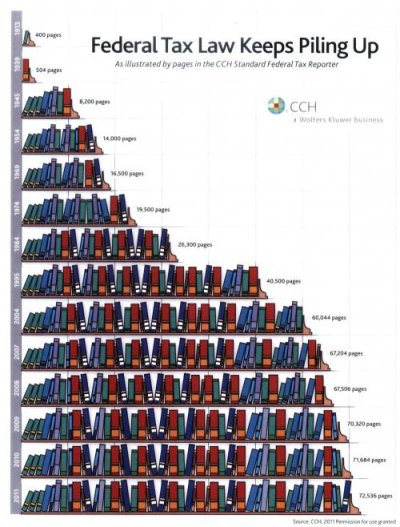

Then one of the experts concludes we should hire more IRS agents to collect the other 15%.How about we simplify the tax code so the average citizen can understand their taxes, and then use all the IRS agents who could be freed up from interpreting the current 5,300 pages, to spend time on more collections.

Jeezzzzz...

Simplifying might help, but I think most of the under-collection is in the good old fashioned cash economy. Every year we have income that the IRS wouldn't know about if we didn't claim it. It comes in the form of 1099s that don't get filed and rental income that isn't reported to anyone. I know plenty of folks who run cash businesses or do cash work on the side. Simplifying the code won't capture any of this if it isn't already being reported.

I also think this is one of those things like "waste fraud and abuse" that gets everyone excited because it seems like a painless way to make our fiscal troubles go away. The problem is, every year politicians claim to go after these things and they never seem to generate any real cash.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Fiscal troubles wasn't my central point...but OK.Simplifying might help, but I think most of the under-collection is in the good old fashioned cash economy. Every year we have income that the IRS wouldn't know about if we didn't claim it. It comes in the form of 1099s that don't get filed and rental income that isn't reported to anyone. I know plenty of folks who run cash businesses or do cash work on the side. Simplifying the code won't capture any of this if it isn't already being reported.

I also think this is one of those things like "waste fraud and abuse" that gets everyone excited because it seems like a painless way to make our fiscal troubles go away. The problem is, every year politicians claim to go after these things and they never seem to generate any real cash.

Real tax code simplification would have an additional effect, difficult to measure but of incredible potential, which would be to redirect America's best and brightest away from tax avoidance schemes and allow them to contribute to the economy in a more productive manner.

I don't think your single son is a good example. I think of low income families with dependents and mortgages (often exceeds standard deduction).

I've heard the 47% pay no FIT, so I had to look further.http://www.cbpp.org/cms/index.cfm?fa=view&id=3505

Thank you. I was responding to the statement "I would think that that would cover at least everyone making under $30K/year."

Your post is excellent and shows clearly the demographics of those who pay no federal income taxes.

grasshopper

Thinks s/he gets paid by the post

- Joined

- Oct 9, 2010

- Messages

- 2,472

Real tax code simplification would have an additional effect, difficult to measure but of incredible potential, which would be to redirect America's best and brightest away from tax avoidance schemes and allow them to contribute to the economy in a more productive manner.

Feeling a bit Pollyanna today.

M Paquette

Moderator Emeritus

MichaelB said:Real tax code simplification would have an additional effect, difficult to measure but of incredible potential, which would be to redirect America's best and brightest away from tax avoidance schemes and allow them to contribute to the economy in a more productive manner.

DW and I have filed our Federal and State returns. All eighty pages with required worksheets. Schedules A, B, D, 8949, 1116, et cetera, et cetera, and so forth... Our effective Federal tax rate comes to 0.53%. Yah, a half of one percent. Gosh, I feel ever so productive.

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

Simplifying might help, but I think most of the under-collection is in the good old fashioned cash economy. Every year we have income that the IRS wouldn't know about if we didn't claim it. It comes in the form of 1099s that don't get filed and rental income that isn't reported to anyone. I know plenty of folks who run cash businesses or do cash work on the side. Simplifying the code won't capture any of this if it isn't already being reported.

I also think this is one of those things like "waste fraud and abuse" that gets everyone excited because it seems like a painless way to make our fiscal troubles go away. The problem is, every year politicians claim to go after these things and they never seem to generate any real cash.

I think the point of the post is that if we had a simpler code we could free up some of the agents who are currently arguing with taxpayers about labor income vs. capital income (for example), and they could look for ways to capture the completely unreported income.

I'll agree that closing loopholes is one of those things that politicians love to talk about when they are talking to ordinary voters, but creating new loopholes (or keeping the IRS from looking too closely) is more popular when they are looking for campaign contributions.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

I'll agree that closing loopholes is one of those things that politicians love to talk about when they are talking to ordinary voters, but creating new loopholes (or keeping the IRS from looking too closely) is more popular when they are looking for campaign contributions.

Voters are bought off with loopholes too, they just don't call them that. They're called mortgage interest and charitable giving deductions or child-care credits and dependent exemptions. People love them and woe upon any politician who wants to take them away. They're not loopholes though. Loopholes are tax breaks that other people get.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1!Real tax code simplification would have an additional effect, difficult to measure but of incredible potential, which would be to redirect America's best and brightest away from tax avoidance schemes and allow them to contribute to the economy in a more productive manner.

Well done!DW and I have filed our Federal and State returns. All eighty pages with required worksheets. Schedules A, B, D, 8949, 1116, et cetera, et cetera, and so forth... Our effective Federal tax rate comes to 0.53%. Yah, a half of one percent. Gosh, I feel ever so productive.

While yours is an excellent example of the effort needed to file a tax return, what I really had in mind was something like this

Barclays’ controversial tax planning business will come under fresh scrutiny in a US court this week over whether a transaction designed by the bank cost the US government more than $1bn in lost tax receipts. The US Internal Revenue Service claims that complex, cross-border deals Barclays structured for several mid-tier banks in the last decade were an abusive tax shelter that exploited loopholes between US and UK tax laws. Barclays’ tax deals face US scrutiny - FT.com

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

But where does it end? No question in my mind federal income taxes have become far too complex.Voters are bought off with loopholes too, they just don't call them that. They're called mortgage interest and charitable giving deductions or child-care credits and dependent exemptions. People love them and woe upon any politician who wants to take them away. They're not loopholes though. Loopholes are tax breaks that other people get.

Attachments

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,428

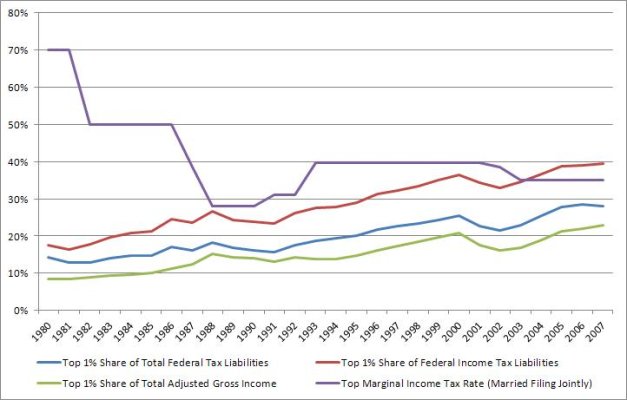

My view: The really, really rich have always been able to dodge the tax man. They just have options that the rest of us don't have.

"Residing" in tax favorable countries, getting the corporation to own that jet/house in France/trip to Rio/etc, keeping that income $10 under the $1MM mark and so on.

Until recently, the US has been somwhat immune from the 'eat the rich' mentality but in Europe it has been a fruitless game for decades. (remember the old term: "tax exiles"?)

Going after "the rich" is a waste of time and only makes for good political theater.

Cut all the loopholes you want. Reform the tax code. Bring the tax rate to 50%! It won't matter.

Is it fair? No. But, as it has always been, it will be you and I who pay the 'fair share'.

"Residing" in tax favorable countries, getting the corporation to own that jet/house in France/trip to Rio/etc, keeping that income $10 under the $1MM mark and so on.

Until recently, the US has been somwhat immune from the 'eat the rich' mentality but in Europe it has been a fruitless game for decades. (remember the old term: "tax exiles"?)

Going after "the rich" is a waste of time and only makes for good political theater.

Cut all the loopholes you want. Reform the tax code. Bring the tax rate to 50%! It won't matter.

Is it fair? No. But, as it has always been, it will be you and I who pay the 'fair share'.

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think we're all going to have to actually pay more when all is said and done, but FWIW regarding "the rich." Too many folks focus on rates when they seem to have little to do with actual taxes paid (to your point somewhat). But I don't see how many fewer loopholes (with/out rate adjustments) couldn't improve collections and fairness, but I realize easier said than done...My view: The really, really rich have always been able to dodge the tax man. They just have options that the rest of us don't have.

"Residing" in tax favorable countries, getting the corporation to own that jet/house in France/trip to Rio/etc, keeping that income $10 under the $1MM mark and so on.

Until recently, the US has been somwhat immune from the 'eat the rich' mentality but in Europe it has been a fruitless game for decades. (remember the old term: "tax exiles"?)

Going after "the rich" is a waste of time and only makes for good political theater.

Cut all the loopholes you want. Reform the tax code. Bring the tax rate to 50%! It won't matter.

Is it fair? No. But, as it has always been, it will be you and I who pay the 'fair share'.

Attachments

And don't forget the non-taxation of compensation (namely--employer-paid health insurance). It's worth more (in reduced tax revenue) than either the mortgage interest deduction or charitable giving deductions.Voters are bought off with loopholes too, they just don't call them that. They're called mortgage interest and charitable giving deductions or child-care credits and dependent exemptions.

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

Voters are bought off with loopholes too, they just don't call them that. They're called mortgage interest and charitable giving deductions or child-care credits and dependent exemptions. People love them and woe upon any politician who wants to take them away. They're not loopholes though. Loopholes are tax breaks that other people get.

This is mostly true. IMO, the solution is to get rid of them all, regardless of the name.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

I don't think your single son is a good example. I think of low income families with dependents and mortgages (often exceeds standard deduction).

I've heard the 47% pay no FIT, so I had to look further.

And note the number who pay no FIT has increased dramatically since the recent recession (I did not find a chart that went past 2007, but we know what the current numbers are).

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy Priorities

Thanks for posting this (along with the charts and important quoted text which were in the actual post). I always knew that most of the people in this growing group were low-income people with children as well as the elderly but did not have a breakdown.

I recall seeing my dad's tax returns recently (he is 81) and noticed that he often had no federal income tax liability. Between the low taxation of his SS benefits and the favorable treatment of some pension income, the only thing which really determined whether or not he had a federal IT bill was the presence of OOP medical bills (i.e. dental). And with such a low income threshhold, the 7.5% level he had to pierce was always very low, making nearly all of those bills deductible and often wiping out any remaining AGI. Furthermore, his state tax return treated his income sources even more favorably so he has not had any state income tax bills since he retired.

Can I ask you to please look up something else up? I read all the time about how big the tax code is with all of its pages. But for the many people who file one of the short forms (1040A, 1040EZ), the tax code is pretty much limited to the relatively small instruction bookelts. Over the years, I have not only filed each of the short forms myself but also for friends of mine and never found the tax code to be anywhere near big or unwieldy or a mess or containing thousands of pages as others claim. Do you know or can find out what percent of personal IT returns are made using each of those short forms?

Google is your friend. The first link that came up http://www.irs.gov/pub/irs-soi/12proj.pdf Look at figure ACan I ask you to please look up something else up? I read all the time about how big the tax code is with all of its pages. But for the many people who file one of the short forms (1040A, 1040EZ), the tax code is pretty much limited to the relatively small instruction bookelts. Over the years, I have not only filed each of the short forms myself but also for friends of mine and never found the tax code to be anywhere near big or unwieldy or a mess or containing thousands of pages as others claim. Do you know or can find out what percent of personal IT returns are made using each of those short forms?

You can bet the folks who file a 1040EZ are affected by our complex tax code. Among the ways:I read all the time about how big the tax code is with all of its pages. But for the many people who file one of the short forms (1040A, 1040EZ), the tax code is pretty much limited to the relatively small instruction bookelts. Over the years, I have not only filed each of the short forms myself but also for friends of mine and never found the tax code to be anywhere near big or unwieldy or a mess or containing thousands of pages as others claim.

-- When they suspect (rightly) they are getting ripped off because they can't take advantage of those special loopholes in those thousands of pages their faith in the fairness of the system is shaken and this affects them.

-- When they pay higher prices for everything because of higher overhead costs of companies to meet/exploit the complex tax code.

-- When the economy is stifled (reducing their wages and employment security) because investment capital is utilized less productively in response to government "favorites" in the tax code.

-- When their own FIT needs to be higher to pay for the giveaways to favored entities in the complex tax code.

Gatordoc50

Full time employment: Posting here.

Put the final touches on my taxes yesterday. Ended up with a 1400 AMT bill. Most likely from passive income of rental properties or capital gains from sale of a property. I don't understand the AMT. The taxes I paid were in line with others in my tax bracket. Anyway, I am closing on the sale of my practice on May 11 so they won't have GarorDoc to kick around any more!!

W2R

Moderator Emeritus

I finished my taxes months ago - - owed the IRS $370, and Louisiana owed me $151. I lost about three or four cents in interest by paying the IRS early this year.

I know, I know, that was not LBYM! The next thing you know, I'll start using dryer sheets.

The next thing you know, I'll start using dryer sheets.

I know, I know, that was not LBYM!

The next thing you know, I'll start using dryer sheets.

The next thing you know, I'll start using dryer sheets. scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

You can bet the folks who file a 1040EZ are affected by our complex tax code. Among the ways:

-- When they suspect (rightly) they are getting ripped off because they can't take advantage of those special loopholes in those thousands of pages their faith in the fairness of the system is shaken and this affects them.

-- When they pay higher prices for everything because of higher overhead costs of companies to meet/exploit the complex tax code.

-- When the economy is stifled (reducing their wages and employment security) because investment capital is utilized less productively in response to government "favorites" in the tax code.

-- When their own FIT needs to be higher to pay for the giveaways to favored entities in the complex tax code.

This was not my point or part of my question. For those who file Form 1040A or 1040EZ (which, according to the link provided by MichaelB (thank you), about 30-33% of returns use one of those short forms, so most of the tax code does not matter when taking the time to prepare one's return on those short forms. It took me about 5 minutes to complete a return on 1040EZ and about 10 minutes on 1040A, hardly the onerous task requiring one to look up the 5,000 pages of the tax code but instead a few pages in one of the instruction booklets (especially 1040EZ).

Similar threads

- Replies

- 15

- Views

- 7K

- Replies

- 38

- Views

- 39K