Just looking at my International holdings and even though International only makes up 5% (Thank God) of my total equity holdings, I can't help but feel John Bogle was right. With many companies deriving significant revenue from international sales.....why own international companies? My reasoning was that since the headquarters of these companies were domiciled outside the USA, the only way to own them was to own an international fund/ETF.

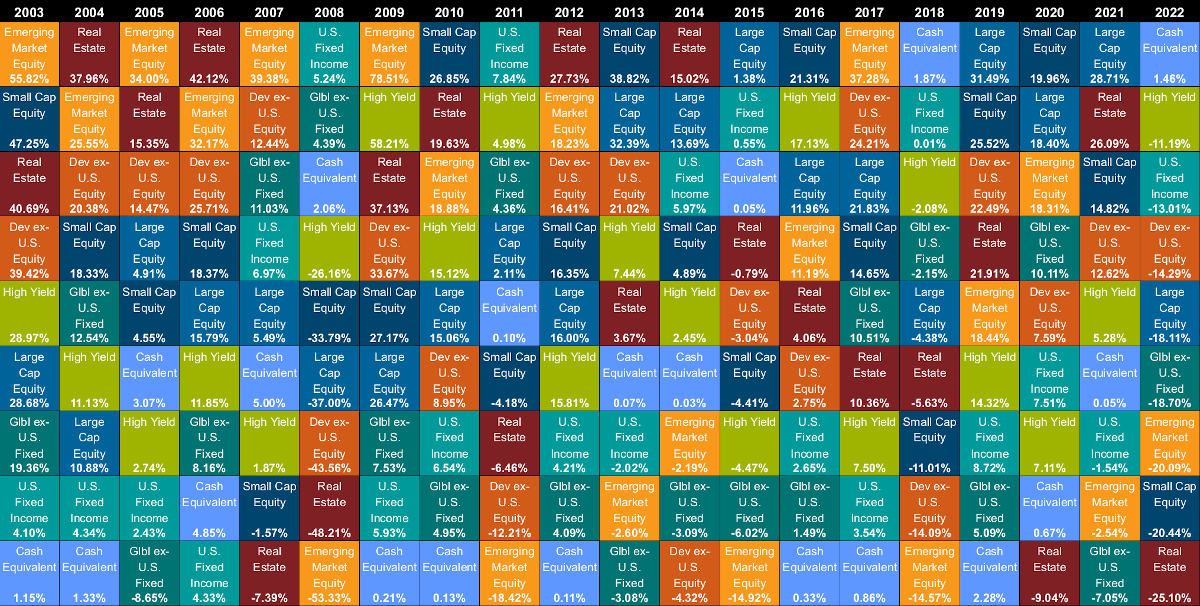

But wow.......domestic funds have averaged 10-12% over the past 5 years....international a little over 1%. I realize that a big factor has been that emerging markets have gotten slaughtered along with ongoing problems in Europe and Japan along with currency risks but seriously.....1% average over the past 5 years

I know that past results are no guarantee of future returns and who knows what the future holds but is anyone seeing things differently?

But wow.......domestic funds have averaged 10-12% over the past 5 years....international a little over 1%. I realize that a big factor has been that emerging markets have gotten slaughtered along with ongoing problems in Europe and Japan along with currency risks but seriously.....1% average over the past 5 years

I know that past results are no guarantee of future returns and who knows what the future holds but is anyone seeing things differently?