street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,539

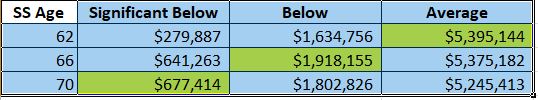

First I want to thank the FIRE community for all the thoughtful posts. Been retired since July 2015 at age 57 and this first bear market has made me do a bit more analysis. I had relied on FireCalc but based on info from this board I tried the Fidelity retirement tool this afternoon to model collecting SS for my DW and myself at 62, FRA(66.5) and 70. I'm 61 and DW is 60. After running the tool I get 3 different ages that maximize your SS benefits using the metric of "Assets at End" (i.e. how much we leave when we croak at 90).

Age 70 "wins" with $677K in a significantly below average market vs. $280K at 62

FRA "wins" with $1.9M in a below average market vs. $1.6M at 62 and $1.8M at 70

Age 62 "wins" with $5.4M in an average market vs. $5.2M at 70 and $5.3M at 65

I've been leaning towards 62 because my other modeling (which I guess was average returns) tended to agree with Fidelity. So depending on my optimism or pessimism I can talk myself into collecting at 3 different ages...so many choices.

Or like Dirty Harry said "Are you feeling lucky?"

Thanks >> that is very interesting.