Well, after some dilly-dallying, decided that it is time to take the plunge to BUY AND HOLD in a diversified mix of stocks and bonds, even though all of my emotions are saying:

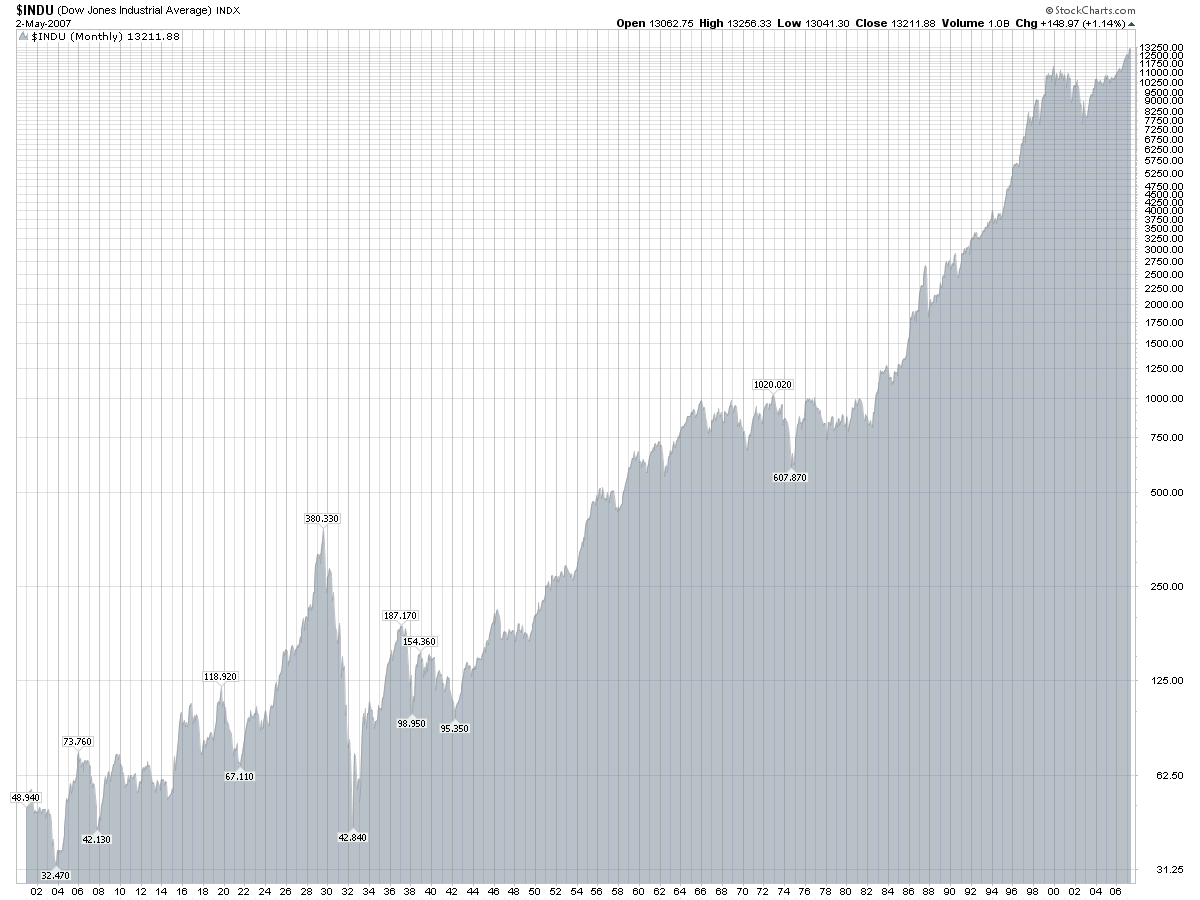

A. This market is frothy

B. Cannot trust the market because it is "rigged" (a lot of ppl have this notion and it is hard to ignore, given the existence of computer algorithms for trading stocks, central banks and such)

C. May be investing at or near the "top" (if such exists)

D. Bonds have been performing crappily

E. Upcoming rate hike decision, european elections, mkts, debt ceiling bla bla

Currently have about 65% of funds in a money market account and 35% in an IRA that invests in both US and int'l stocks + bonds.

I really want to put the 65% to work (thanks all for the help before in deciding a good mix of stock + bond funds), but what is stopping me ATM is a strong tendency to pull out of the market when things get rough.

I DO NOT want to look at my investment performance but feel on guard with the current climate, toppiness of the market + volatility -- I NEED to rebalance if needed or take advantage of a market plunge by adding more cash, say.

But if I look at my investments at all, I will freak out!

How do you guys keep from market timing or panicking when things go south?

A. This market is frothy

B. Cannot trust the market because it is "rigged" (a lot of ppl have this notion and it is hard to ignore, given the existence of computer algorithms for trading stocks, central banks and such)

C. May be investing at or near the "top" (if such exists)

D. Bonds have been performing crappily

E. Upcoming rate hike decision, european elections, mkts, debt ceiling bla bla

Currently have about 65% of funds in a money market account and 35% in an IRA that invests in both US and int'l stocks + bonds.

I really want to put the 65% to work (thanks all for the help before in deciding a good mix of stock + bond funds), but what is stopping me ATM is a strong tendency to pull out of the market when things get rough.

I DO NOT want to look at my investment performance but feel on guard with the current climate, toppiness of the market + volatility -- I NEED to rebalance if needed or take advantage of a market plunge by adding more cash, say.

But if I look at my investments at all, I will freak out!

How do you guys keep from market timing or panicking when things go south?