Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

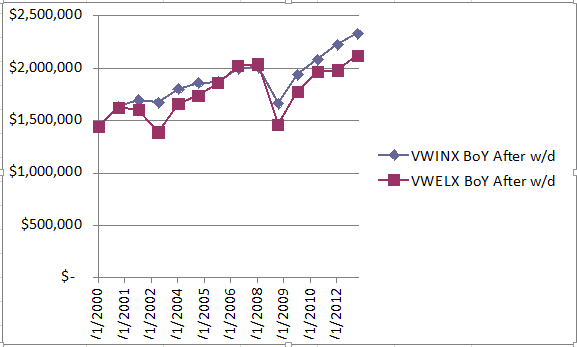

Some may remember that Christine Benz of Morningstar published an interesting set of articles in Aug 2013 on a Bucket Stress Test. The last article was on 22 Aug 2013, titled "We put the Bucket System Through a Longer Stress Test", for a period from 1 Jan 2000 to 1 Jan 2013. The plan was for a 4% draw on Jan 1 of each year, increased by 3% every year. The portfolio started with $1.5MM, with $120k (2 years of withdrawals) in cash and the balance in a collection of mutual funds providing 60/40 mix of equities and bonds, rebalanced using a rule. The long stress test had a final balance of $2,029,138.

I did a comparison using Wellington (VWELX, also 60/40) and also Wellesley (VWINX, 40/60) but no cash bucket. VWELX ended up with a final balance of $2,207,649, about 10% more than the Bucket Stress Test portfolio. (!) (VWINX had $2,329,993 left, which was surprising, and is that difference repeatable in the next 12 years? Still, it did not have the low bottoms as VWELX did.)

It looks like either fund would be a lot simpler and better than managing the Buckets portfolio.

With an eye on my coming de-cumulation phase, I tried to make a comparison between my portfolio performance (basically 100% equities) and VWELX and VWINX over comparable periods (I don't have data readily on hand for performance before 2004 for me). Over 8 years from 2004 through 2014, VWELX provided 5.4% return, VWINX provided a 5.8% return and my portfolio returned 5.2% (if I did not make any arithmetic mistakes). Although I use mostly index funds, I have been slicing-and-dicing and also collecting a few oil and gas and pipeline stocks, trying to fill up my pot. It looks like in de-cumulation, I would be better off with simply one fund instead of my collection (as would the Bucket portfolio!). This would unburden us of managing a portfolio in our dotage and simplify life for the survivor.

Whadaya say, Uncle Mick?

I did a comparison using Wellington (VWELX, also 60/40) and also Wellesley (VWINX, 40/60) but no cash bucket. VWELX ended up with a final balance of $2,207,649, about 10% more than the Bucket Stress Test portfolio. (!) (VWINX had $2,329,993 left, which was surprising, and is that difference repeatable in the next 12 years? Still, it did not have the low bottoms as VWELX did.)

It looks like either fund would be a lot simpler and better than managing the Buckets portfolio.

With an eye on my coming de-cumulation phase, I tried to make a comparison between my portfolio performance (basically 100% equities) and VWELX and VWINX over comparable periods (I don't have data readily on hand for performance before 2004 for me). Over 8 years from 2004 through 2014, VWELX provided 5.4% return, VWINX provided a 5.8% return and my portfolio returned 5.2% (if I did not make any arithmetic mistakes). Although I use mostly index funds, I have been slicing-and-dicing and also collecting a few oil and gas and pipeline stocks, trying to fill up my pot. It looks like in de-cumulation, I would be better off with simply one fund instead of my collection (as would the Bucket portfolio!). This would unburden us of managing a portfolio in our dotage and simplify life for the survivor.

Whadaya say, Uncle Mick?