true; but I took "retiring" as a assumed condition for the purposes of analytics. Not retiring is always one option to making the numbers work (whether it is SS or no SS ever). I do taxes for a lot of people who work until they die because they have nothing. But I don't consider working until death a "retirement" strategy.Or if you need it, work longer and delay. That way, there will be no gap.

For many, that is the best strategy.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New Social Security study on claiming it too early

- Thread starter explanade

- Start date

Working until death is not a "retirement" strategy. For some, it's a "survival" strategy, particularly when you have nothing.But I don't consider working until death a "retirement" strategy.

Working longer while delaying social security benefits is clearly a viable retirement strategy that makes sense for many.

Last edited:

EarlyBirdly

Recycles dryer sheets

- Joined

- Oct 24, 2016

- Messages

- 205

That was the most ridiculous, non-sensical, little blurb I think I have ever read regarding S.S. and distributions.

To each his/her own - I'll take the Bird in the Hand and if I win the lottery I'll take the Lump Sum. Thank You.

P.S. - Really "healthy" people die everyday. I'm sure they didn't expect the Bus to hit them or that undetected cancer to cut their lives short but, things happen I guess. Much like my extremely healthy 54 yr. old friend who played Hockey every time he could, was never an ounce overweight in his life, etc. Stage 4 Pancreatic Cancer gave him 18 months to get his collective junk together. He does not have to worry about his S.S. claiming strategy anymore...

To each his/her own - I'll take the Bird in the Hand and if I win the lottery I'll take the Lump Sum. Thank You.

P.S. - Really "healthy" people die everyday. I'm sure they didn't expect the Bus to hit them or that undetected cancer to cut their lives short but, things happen I guess. Much like my extremely healthy 54 yr. old friend who played Hockey every time he could, was never an ounce overweight in his life, etc. Stage 4 Pancreatic Cancer gave him 18 months to get his collective junk together. He does not have to worry about his S.S. claiming strategy anymore...

Last edited:

Sorry to hear about your friend.Much like my extremely healthy 54 yr. old friend who played Hockey every time he could, was never an ounce overweight in his life, etc. Stage 4 Pancreatic Cancer gave him 18 months to get his collective junk together. He does not have to worry about his S.S. claiming strategy anymore...

But what kind of lesson do you expect people to take from that anecdote? Should have retired at 53? How does that have anything to do with a Social Security claiming strategy?

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

I've opined a few times here that, health aside, there are two types who take SS early:

Those desperate for the money and those who don't need it at all and want to have extra 'fun money' to enjoy now.

Those who need/want to maximize their income will wait for FRA or 70.

Those desperate for the money and those who don't need it at all and want to have extra 'fun money' to enjoy now.

Those who need/want to maximize their income will wait for FRA or 70.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... The lost income from these less-than-optimal decisions amounts to about $111,000 per household, the researchers estimate. ...

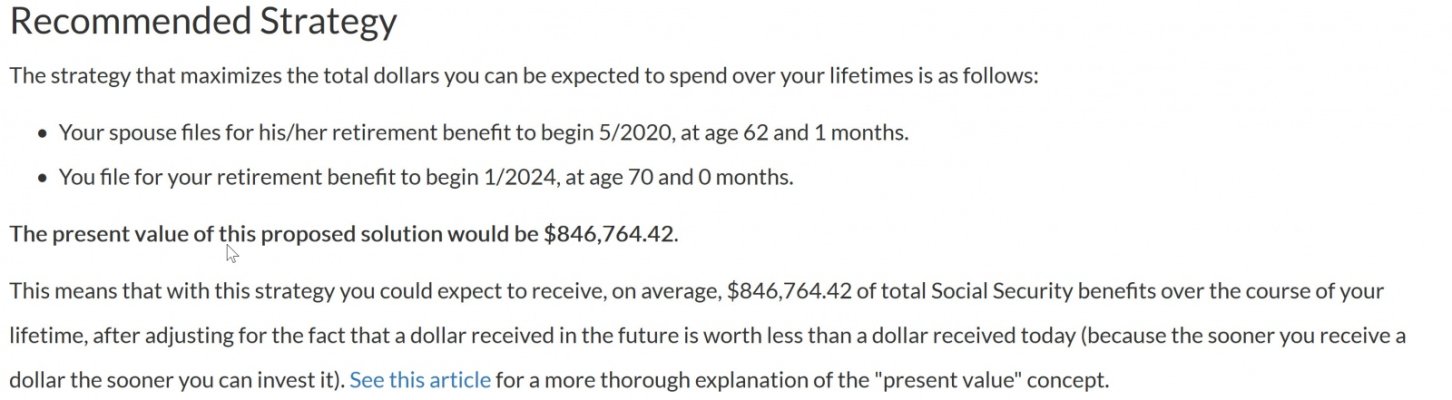

Note this $110,000 is undiscounted. If I use our numbers assuming SS pays 100% on opensocialsecurity.com undiscounted I get $160k difference between "optimal" strategy and claiming at 62.. but with a 3% real discount rate it is only $26k.

Interestingly, if I add in a 23% haircut beginning in 2034 then the difference is $0 (surprised me too).

But I guess that $18k or $0 would not have been sensational enough.

Last edited:

I've opined a few times here that, health aside, there are two types who take SS early:

Those desperate for the money and those who don't need it at all and want to have extra 'fun money' to enjoy now.

There are certainly more than two types.

My brother in law is one. He took it at 62 not because of health, not because he was desperate for money, and not because he wanted to have extra 'fun money'.

He took it because 62 was the very first point in time when he could take it, and he was in the 'bird in hand' group. Interestingly enough he was still working at the time.

He's a lot older and is retired now. He would have been better served to delay at least until he was no longer working, and probably until he was 70. Oh well.

Last edited by a moderator:

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There are no guarantees of course. If you have no major health issues and longevity runs in the family, those would be my indicators.

And they left out the factor I consider, by far, the most important: the opportunity cost of missed investment gains/income from having the money eight years earlier.

If you can afford to delay SS until 70, you can also afford to start SS at 62 and use the monthly check to dollar cost average into a low cost TSM index fund (periodic monthly investment actually) for eight years. This past decade, that would have put the "take it at 62 crowd" ahead of the "delay until 70 crowd" for their lifetimes. Of course, a decade of crappy market performance would not turn out so well.......

I continue to be fascinated as to why these studies generally ignore the time value of money when it is such an important factor.

Last edited:

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I've opined a few times here that, health aside, there are two types who take SS early:

Those desperate for the money and those who don't need it at all and want to have extra 'fun money' to enjoy now.

Those who need/want to maximize their income will wait for FRA or 70.

Actually there is a third type: folks who want the money earlier for investment purposes. I suppose you might call that "fun money." But just having my early SS checks buy into a low cost TSM index fund every month for eight years was actually boring, although the results were very nice.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

Can you explain what this 'discount ' is about? Discount from what? What is this "3% real discount rate" about?Note this $110,000 is undiscounted. If I use our numbers assuming SS pays 100% on opensocialsecurity.com undiscounted I get $160k difference between "optimal" strategy and claiming at 62.. but with a 3% real discount rate it is only $26k.

Interestingly, if I add in a 23% haircut beginning in 2034 then the difference is $0 (surprised me too).

But I guess that $18k or $0 would not have been sensational enough.

Question not a challenge.

Last edited:

Ready-4-ER-at-14

Full time employment: Posting here.

To me the thing that mucks up the when to take question is the "hanging sword of Damacles" the threat that waiting 5 years or more to take a say 30% benefit that will be means tested then and possibly reduced by 30% because the government lied about providing about 1/3 of retirement costs if we paid for life. (the 3 legged stool, pension, savings, social security)

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

I probably should have said " those desperate for the money and those who might find it nice to have " and left it at that.Actually there is a third type: folks who want the money earlier for investment purposes. I suppose you might call that "fun money." But just having my early SS checks buy into a low cost TSM index fund every month for eight years was actually boring, although the results were very nice.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

The one big thing which may affect when I decide to claim SS is being diagnosed with Type 2 Diabetes 4 years ago. While it is under control (I am at the milder end of its spectrum of problems), I do wonder how much it will reduce my life expectancy.

Some other thoughts on timing SS distributions:

1) ACA - SS benefits count as MAGI, including the non-taxable SS benefits. So if you are on the ACA getting PCT and possible CSR from age 62 to 65, taking SS during those years could cause you to lose both.

2) UBI - Some UBI plans eliminate SS and replace it with a flat amount. If you had been waiting past age 62 to receive a higher SS, you get no more UBI than the person who already started taking SS at 62.

3) Preserve stash - in the event you die before age 77, you could leave more stash to your family by starting benefits early. Of course, if you live into your 80's, taking early can have the opposite effect.

1) ACA - SS benefits count as MAGI, including the non-taxable SS benefits. So if you are on the ACA getting PCT and possible CSR from age 62 to 65, taking SS during those years could cause you to lose both.

2) UBI - Some UBI plans eliminate SS and replace it with a flat amount. If you had been waiting past age 62 to receive a higher SS, you get no more UBI than the person who already started taking SS at 62.

3) Preserve stash - in the event you die before age 77, you could leave more stash to your family by starting benefits early. Of course, if you live into your 80's, taking early can have the opposite effect.

Note this $110,000 is undiscounted. If I use our numbers assuming SS pays 100% on opensocialsecurity.com undiscounted I get $160k difference between "optimal" strategy and claiming at 62.. but with a 3% real discount rate it is only $26k.

+1

I would venture a guess that for "most" healthy people that have funds to get by until SS distribution time (whenever that is), it doesn't make a whole lot of difference when they start taking it.

I (we) plan on taking SS sometime between 62 and 70. It's doubtful that whatever ages we pick will have any significant impact on our financial well being.

That being said, I still read every one of these SS posts thinking someone will give me the exact right answer

gwraigty

Thinks s/he gets paid by the post

Some other thoughts on timing SS distributions:

1) ACA - SS benefits count as MAGI, including the non-taxable SS benefits. So if you are on the ACA getting PCT and possible CSR from age 62 to 65, taking SS during those years could cause you to lose both.

2) UBI - Some UBI plans eliminate SS and replace it with a flat amount. If you had been waiting past age 62 to receive a higher SS, you get no more UBI than the person who already started taking SS at 62.

3) Preserve stash - in the event you die before age 77, you could leave more stash to your family by starting benefits early. Of course, if you live into your 80's, taking early can have the opposite effect.

4) Highest monthly SS household income - lower earning spouse claims at FRA of 67 on own record, higher earning spouse claims at 70 when lower earning spouse switches to spousal benefit

workmyfingerstothebone

Recycles dryer sheets

- Joined

- Oct 11, 2013

- Messages

- 117

Reason 4.)

Don't need the SS funds at 62 but taking them as the spouse is younger than I.

If something happens to me the spouse at least gets something.

Don't need the SS funds at 62 but taking them as the spouse is younger than I.

If something happens to me the spouse at least gets something.

gwraigty

Thinks s/he gets paid by the post

Reason 4.)

Don't need the SS funds at 62 but taking them as the spouse is younger than I.

If something happens to me the spouse at least gets something.

You don't have to claim SS for a surviving spouse to get SS survivor benefits. The yearly SS benefits statements have the amount of potential survivor benefits listed. We're both too young to claim SS, yet if my husband were to die before being eligible, I'd still get survivor benefits of $2679/mo. at FRA, less if I claimed earlier, of course. Also, the survivor has to be at least 60 to claim any survivor benefits.

I am one of those people who started at 62 and have it 100% for investment.

Because of growth in the market the past 10 years this has worked out very well.

I started reading this forum about that time but only signed up recently.

I have learned so much about so many things here and I thank you all.

Because of growth in the market the past 10 years this has worked out very well.

I started reading this forum about that time but only signed up recently.

I have learned so much about so many things here and I thank you all.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

....If you can afford to delay SS until 70, you can also afford to start SS at 62 and use the monthly check to dollar cost average into a low cost TSM index fund (periodic monthly investment actually) for eight years. This past decade, that would have put the "take it at 62 crowd" ahead of the "delay until 70 crowd" for their lifetimes. ...

Even after a decade it may be too early to declare victory with 3 decades left to go.

Can you explain what this 'discount ' is about? Discount from what? What is this "3% real discount rate" about?

Question not a challenge.

A discount rate is an interest/investment gains rate representing a rate of return on your investments. "3% real" is an interest rate of 3% + inflation. So that might be an actual 6% gains but minus 3% inflation for a "real" gain of 3%.

Most SS claiming strategy discussions assume a 0% discount rate. That assumes that SS would have no impact on your investing, and that a $1 today is worth the same as an inflation adjusted $1 in 2040. So probably not a great assumption.

It seems much more reasonable to assume taking SS early would allow you to reduce the withdrawal rate from your investments, which would give you some rate of return. If you have a high enough rate of return early SS looks better. But then SS is presumably low risk, so should that assumed rate of return be more bond-like, match your total AA return, or what you would get at a bank?

And they left out the factor I consider, by far, the most important: the opportunity cost of missed investment gains/income from having the money eight years earlier.

If you can afford to delay SS until 70, you can also afford to start SS at 62 and use the monthly check to dollar cost average into a low cost TSM index fund (periodic monthly investment actually) for eight years. This past decade, that would have put the "take it at 62 crowd" ahead of the "delay until 70 crowd" for their lifetimes. Of course, a decade of crappy market performance would not turn out so well.......

I continue to be fascinated as to why these studies generally ignore the time value of money when it is such an important factor.

Here's a quote directly from the study that indicates they DID attempt to take into account missed investment gains/income (they go into more depth on methodology in the article, previously linked - https://unitedincome.com/documents/papers/RetirementSolutionHidinginPlainSight.pdf):

"At the same time, there are critical limitations in the existing academic work. Much of it has been theoretical, which means the data about house-holds used in the analyses has been made-up to analyze different scenarios. Similarly, much existing work has artificially narrowed the analysis to focus only on maximizing the (net-present) value of Social Security benefits, while ignoring the trade-offs most U.S. retirees face between claiming Social Security or withdrawing from investment accounts. And, economists that do take this house-hold reality into account have tended to only consider a single future market scenario for investment accounts (e.g., equity markets increase in value every year by the same amount) or have ignored other interdependencies, such as how spending varies across different households."

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If they did take the time value of money into account somehow then the $110,000 doesn't make much sense.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Can you explain what this 'discount ' is about? Discount from what? What is this "3% real discount rate" about?

Question not a challenge.

The discount rate is to reflect the time value of money. The 3% real is net of inflation... a real discount rate is appropriate for something like SS because SS benefits increase by inflation so a real rate would be used.

Similar threads

- Replies

- 307

- Views

- 27K

- Replies

- 6

- Views

- 1K

- Locked

- Replies

- 127

- Views

- 7K