street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,565

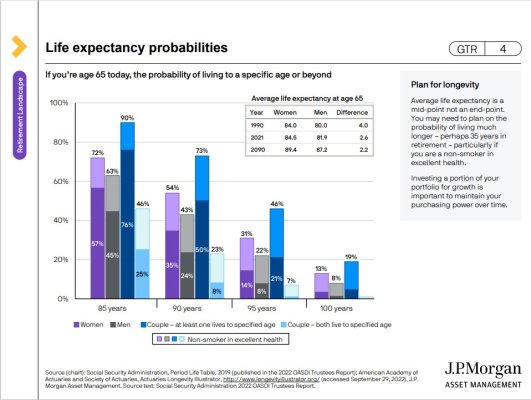

Taking SS is another risk level event for each of us, just like each personal risk factor is for AA percentages we want to do as we age.

Here is the current average age of life expectancies in the US. So, 50% of us make these age and more and 50% of us fall short of those ages shown.

Both sexes: 76.4 years

Males: 73.5 years

Females: 79.3 years

Here is the current average age of life expectancies in the US. So, 50% of us make these age and more and 50% of us fall short of those ages shown.

Both sexes: 76.4 years

Males: 73.5 years

Females: 79.3 years