Andre1969

Thinks s/he gets paid by the post

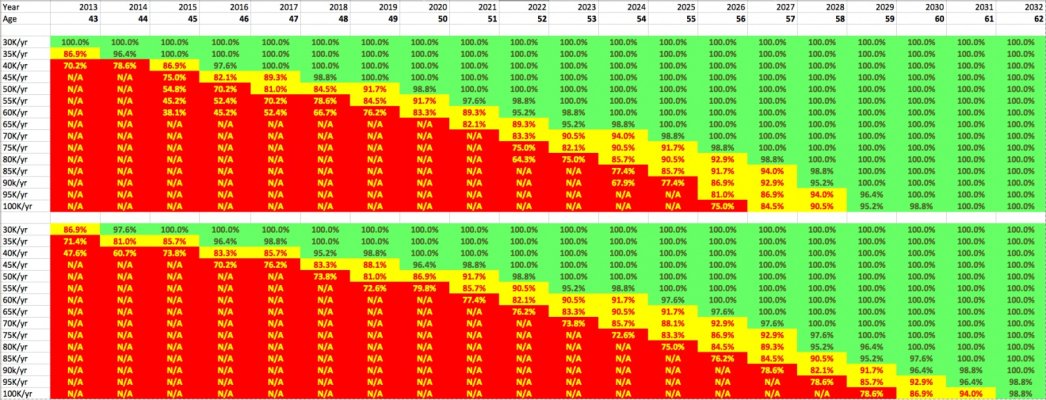

I just put a bunch of scenarios into a table, which shows how much I can withdraw per year, for any given year that I choose to retire. Now, it might be a bit optimistic, as I included full social security benefits, a non-Cola'd pension of ~$4,000 per year I get at age 65, and saving an additional $20,000 per year until I retire. I also wanted the portfolio to last until age 100. I'm currently 42, but might as well say 43, as my birthday is in April. Oh, and i wanted at least a 95% success rate. Anyway, here's the numbers:

2013, age 43: $30,000 per year (I could actually do this if I put my mind to it, but it would be bare-bones)

2014, age 44: $35K

2016, age 46: $40K (this is kinda where I want to go out, but as 2016 draws nearer, I find myself getting cold feet)

2018, age 48: $45K

2020, age 50: $50K

2021, age 51: $55K

2022, age 52: $60K

2023, age 53: $65K

2025, age 55: $70K

2026, age 56, $75K

2027, age 57, $80K (so if I sacrifice just 11 more years, I can double my withdrawals)

2028, age 58, $90K

2029, age 59, $100K

Interestingly, if I take social security and my pension out of the equation completely, it only pushes me back by 1-3 years. For instance, I'd be able to do $40K per year at 48, $80K per year at 58, and $100K per year at 62. Dunno why the $80K threshold only got pushed back 1 year, maybe it hit some sort of sweet spot in the FireCalc formula?

Anyway, sometimes I wish I hadn't made this table. For one thing, it shows that I could really bail on the workforce right now if I truly wanted to. But it also shows the effect of "One More Year" (or in some cases "Two More Years")

While I'm sure I'd be happy on $40K per year, especially once the mortgage is paid off, I can see the temptation to stick it out just a bit longer. Even if I retired at 55, that's still pretty early. And at that point I'd be able to do $70K per year.

2013, age 43: $30,000 per year (I could actually do this if I put my mind to it, but it would be bare-bones)

2014, age 44: $35K

2016, age 46: $40K (this is kinda where I want to go out, but as 2016 draws nearer, I find myself getting cold feet)

2018, age 48: $45K

2020, age 50: $50K

2021, age 51: $55K

2022, age 52: $60K

2023, age 53: $65K

2025, age 55: $70K

2026, age 56, $75K

2027, age 57, $80K (so if I sacrifice just 11 more years, I can double my withdrawals)

2028, age 58, $90K

2029, age 59, $100K

Interestingly, if I take social security and my pension out of the equation completely, it only pushes me back by 1-3 years. For instance, I'd be able to do $40K per year at 48, $80K per year at 58, and $100K per year at 62. Dunno why the $80K threshold only got pushed back 1 year, maybe it hit some sort of sweet spot in the FireCalc formula?

Anyway, sometimes I wish I hadn't made this table. For one thing, it shows that I could really bail on the workforce right now if I truly wanted to. But it also shows the effect of "One More Year" (or in some cases "Two More Years")

While I'm sure I'd be happy on $40K per year, especially once the mortgage is paid off, I can see the temptation to stick it out just a bit longer. Even if I retired at 55, that's still pretty early. And at that point I'd be able to do $70K per year.