You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Poll: Ready to drop brick-n-mortar banking?

- Thread starter Midpack

- Start date

The only thing we use our brick and mortar national bank (Citibank) for is to make deposits that are not electronic and to withdraw money sometimes at the ATM. Our checking account is with them. Zero interest.

The bank is near where my husband works- which is over an hour from our home and has no ATMs around where we live, but once he leaves his job, we need one closer to home I guess. But then again, we are hoping to move out of state so a big pain in the butt.

This is actually on my lost to revise. Maybe change to a bank that is near where we live and also where we hope to move, but not easy. Plus, we have so many automatic transactions going on it will be almost mind boggling to change them all. Ugh!

We do have on line banks- Capital One 360 and Discover. The FP I just had a free trial meeting with suggested we change to Ally Bank for the higher interest. I also told him CIT Bank has even higher interest. ( I knew that but he didn't?)

But, again, we have all the automatic transactions set up at Capital One 360 tied to our checking account and it would be one big hassle to change. But we could get $1000 more in interest for the year if we did. No small chunk of change.

But Capital One 360 allows us to have separate bank accounts under one customer # and I like that because I have different ones for different purposes. Like for example- I have one set up to save for the annual fuel bills we get. Money goes from our checking into that account every month. When we get the fuel oil bill we transfer the money back out of there into our checking account. So at least we have gotten interest on our money since our checking account pays no interest. I have ones set up for our property taxes, a new car, home improvements, our timeshare vacations, insurances, and even a misc one for those one time bigger things that pop up- like XMAS gifts, etc.

And then there is the point that who knows how long their current rate will remain? Capital One 360 used to have the highest rates which is why I opened an account there. Now they are low.

The bank is near where my husband works- which is over an hour from our home and has no ATMs around where we live, but once he leaves his job, we need one closer to home I guess. But then again, we are hoping to move out of state so a big pain in the butt.

This is actually on my lost to revise. Maybe change to a bank that is near where we live and also where we hope to move, but not easy. Plus, we have so many automatic transactions going on it will be almost mind boggling to change them all. Ugh!

We do have on line banks- Capital One 360 and Discover. The FP I just had a free trial meeting with suggested we change to Ally Bank for the higher interest. I also told him CIT Bank has even higher interest. ( I knew that but he didn't?)

But, again, we have all the automatic transactions set up at Capital One 360 tied to our checking account and it would be one big hassle to change. But we could get $1000 more in interest for the year if we did. No small chunk of change.

But Capital One 360 allows us to have separate bank accounts under one customer # and I like that because I have different ones for different purposes. Like for example- I have one set up to save for the annual fuel bills we get. Money goes from our checking into that account every month. When we get the fuel oil bill we transfer the money back out of there into our checking account. So at least we have gotten interest on our money since our checking account pays no interest. I have ones set up for our property taxes, a new car, home improvements, our timeshare vacations, insurances, and even a misc one for those one time bigger things that pop up- like XMAS gifts, etc.

And then there is the point that who knows how long their current rate will remain? Capital One 360 used to have the highest rates which is why I opened an account there. Now they are low.

Last edited:

CRLLS

Thinks s/he gets paid by the post

Grocery store has change machine. If I take an Amazon or iTunes gift card I get full credit for my change - no fees.

I don't think that Aldi has one but Walmart does. That is where we do our grocery shopping. I might try that in 5 years when my can is full again. That is, if Walmart is still in business in 5 years.

watchman3135

Recycles dryer sheets

- Joined

- Jun 28, 2017

- Messages

- 112

Not being a huge bond fan and liking the FDIC coverage, I have been chasing 5 year bank CD promo's and have been holding out for rates to get as close to 4% as possible. Our IT department is being sourced out and as of July 1st of this year, I will be 53 and without a job. We were given a 9 month notice so I really don't have any bitterness toward the company however all my co-workers are in their 30's-40's and are not having much luck finding work let alone an IT person in their 50's. So with early retirement already planned for 55, I'm going a bit earlier than anticipated. I want to open two $250,000 CD's that are paying over 3% for a 5-6 year term. This will be for my fixed allocation portion. I need the income streams so I want to have these two CD's output the interest into a checking account where I can pull from for living expenses. BMO Harris had a 3.50% 5 year but dropped it last week. The issue with chasing the highest promo cd rates is they are usually small or internet only banks. I'm in Illinois and Northpointe Bank has one brick-n-motor location in Michigan and is currently offering a 5 year 3.60% (3.54% rate) however I am a little nervous about banks with only one main branch or sending large sums to internet only banks. Am I wrong in my thinking?

Last edited:

gwraigty

Thinks s/he gets paid by the post

Not being a huge bond fan and liking the FDIC coverage, I have been chasing 5 year bank CD promo's and have been holding out for rates to get as close to 4% as possible. Our IT department is being sourced out and as of July 1st of this year, I will be 53 and without a job. We were given a 9 month notice so I really don't have any bitterness toward the company however all my co-workers are in their 30's-40's and are not having much luck finding work let alone an IT person in their 50's. So with early retirement already planned for 55, I'm going a bit earlier than anticipated. I want to open two $250,000 CD's that are paying over 3% for a 5-6 year term. This will be for my fixed allocation portion. I need the income streams so I want to have these two CD's output the interest into a checking account where I can pull from for living expenses. BMO Harris had a 3.50% 5 year but dropped it last week. The issue with chasing the highest promo cd rates is they are usually small or internet only banks. I'm in Illinois and Northpointe Bank has one brick-n-motor location in Michigan and is currently offering a 5 year 3.60% (3.54% rate) however I am a little nervous about banks with only one main branch or sending large sums to internet only banks. Am I wrong in my thinking?

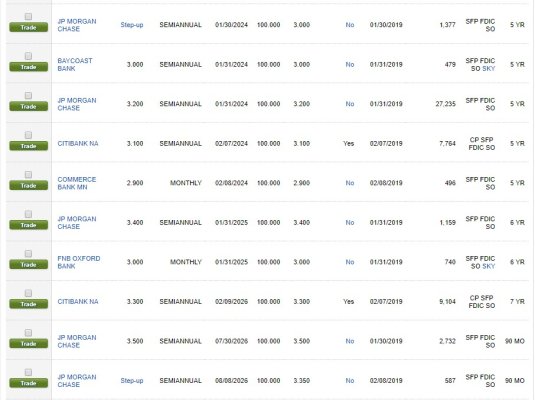

Sorry to hear about your impending job loss. Have you considered buying new-issue CDs in a brokerage account? One account, many banks/rates/maturities to choose from, FDIC insured, and the interest payments will go into the cash/core position in your brokerage account to spend/invest as you choose.

Here is a snip of what is currently available at Fidelity in the 5 yr. to under 10 yr. range:

Attachments

Even though I don't bank at the local bank down the street I just come over for the free cups of coffee. Probably saved about 10K over the last 20 years.Online banking is awesome!

Brick and mortar banking makes a simple and easy solution for cash deposits and then transfer the money. There are also very friendly people who work at the brick and mortar bank I make cash deposits at... and some people like the complementary coffee/tea/drink!

watchman3135

Recycles dryer sheets

- Joined

- Jun 28, 2017

- Messages

- 112

Sorry to hear about your impending job loss. Have you considered buying new-issue CDs in a brokerage account? One account, many banks/rates/maturities to choose from, FDIC insured, and the interest payments will go into the cash/core position in your brokerage account to spend/invest as you choose.

Here is a snip of what is currently available at Fidelity in the 5 yr. to under 10 yr. range:

Thanks gwraigty. I have been looking into brokered CD's also. Any rate of 3.50 or higher would be appealing and the current rate offerings you show certainly apply. I guess I've defaulted to local bricks-n-mortar since I can walk into one and set it up with some human contact. Probably seems rather odd considering my long career as a IT person to some. I think as long as brokerage CD's are FDIC insured, I would be fine with them. I just don't know to much about them.

Last edited:

Rosie

Recycles dryer sheets

Being able to get medallion guarantees is the biggest reason for using a B&M bank, IMO.

When you need medallions, you really, really need them.

Yep. When I was executor of FIL's estate, I needed medallion guarantees for many transactions. I opened an account for the estate at a local B&M bank. Although they handled the medallion guarantees, their service was abysmal. I closed that account as soon as I could after probate closed.

DH & I have been very satisfied with USAA (online only) for day to day transactions -- checking, cash from ATMs, billpay. The interest paid by USAA is almost nonexistent so we keep the bulk of our cash at Ally and transfer a monthly amt from there to USAA.

I answered no.

I bank at a credit union that is 8 states away, with local access if I needed to thru a chain of credit unions loosely linked via some organization, which gets me access to services if need be (like I had 1 check that was bigger than the mobile app allowed).

Not sure I would want to give up the perks of the credit union and not wanting to give up my longest held credit card with a sizeable limit. They treat us well, I can't complain about the special dividend payouts or the 2.85% interest rate on my mortgage.

I bank at a credit union that is 8 states away, with local access if I needed to thru a chain of credit unions loosely linked via some organization, which gets me access to services if need be (like I had 1 check that was bigger than the mobile app allowed).

Not sure I would want to give up the perks of the credit union and not wanting to give up my longest held credit card with a sizeable limit. They treat us well, I can't complain about the special dividend payouts or the 2.85% interest rate on my mortgage.

Similar threads

- Replies

- 17

- Views

- 737

- Replies

- 36

- Views

- 3K