Carpediem

Full time employment: Posting here.

- Joined

- Aug 26, 2016

- Messages

- 770

I want to roll over a small lump sum pension and my 401k from Mega to Vanguard after my last day of employment, 7/5. I currently have one rollover account at VG from a previous employer. What would you recommend for account setup at VG to accept these funds?

A. Should I roll over both the lump sum pension and the 401k into the existing VG rollover account? Is that even allowed?

B. Should I roll over the lump sum pension into a new VG rollover account and do the same for the 401k into its own rollover account?

Btw, I won't be taking monthly payments from the lump sum pension because the amount is less than $20k.

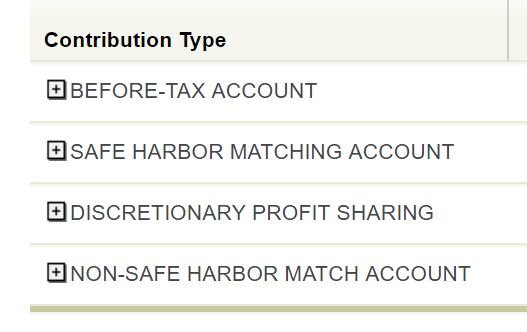

The attached screenshot shows the different contribution types in my 401k. Do they affect what type of account I roll them into?

A. Should I roll over both the lump sum pension and the 401k into the existing VG rollover account? Is that even allowed?

B. Should I roll over the lump sum pension into a new VG rollover account and do the same for the 401k into its own rollover account?

Btw, I won't be taking monthly payments from the lump sum pension because the amount is less than $20k.

The attached screenshot shows the different contribution types in my 401k. Do they affect what type of account I roll them into?