Tiger8693

Full time employment: Posting here.

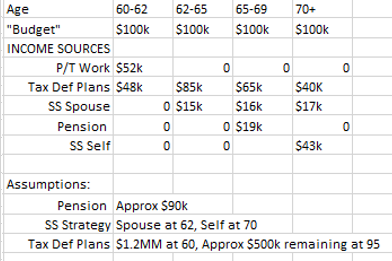

Just playing with some numbers, thinking of how I would work with SS, a small pension, and then tax deferred account. My plan would be to have $100k income (30%-40% more than planned expenses). I do have an after tax account ($~$200k) that I would utilize for planned/unplanned expenses (car, home repairs, etc), but not showing as income for this plan purposes.

Thoughts/comments?

Thoughts/comments?

Attachments

Last edited: