Can you explain how a 22% marginal rate equals a 40.7% marginal tax bracket? Perhaps it's the terminology but I don't understand what you are saying at all.

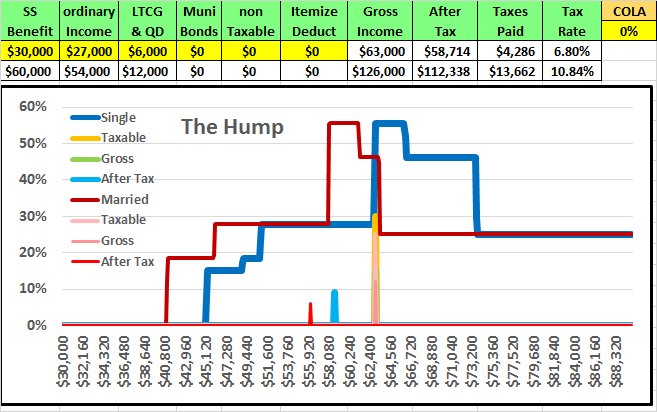

Legislation was passed in 1983 that defined a “basis” for the taxation of your Social Security benefits as half of your SS benefit plus your other taxable income, including government bonds and dividends and LTCGs. When that basis crosses over $25,000 for single tax payers and $32,000 for married, you enter the 50% taxability bracket until 50% of your SS benefits have been taxed.

The legislation taxes dollar for dollar, but I like to use $100 as an example to make the results easier to follow.

If you are in that “taxability” bracket and take an additional $100 out of your IRA or any other taxable source, $50 of your previously tax free SS benefit becomes taxable income, so a $100 withdraw increases your taxable income by $150. If you are in the new 12% tax bracket, 12% of $150 results in a $18 increase in your taxes and $18 is 18% of $100. Your tax bracket is 12%, but your “Marginal” tax rate is 18%.

The 1993 legislation added a second taxability category of 85% taxability until 85% of your SS benefits have been taxed. This second category starts at $34,000 if you are single and $44,000 if you are married.

All of the taxability points, $25,000, $32,000, $34,000, and $44,000 are NOT COLA adjusted. The lack of a COLA adjustment was done so that the amount of taxation would increase with inflation.

Can you explain how a 22% marginal rate equals a 40.7% marginal tax bracket? Perhaps it's the terminology but I don't understand what you are saying at all.

OK, now to your specific question: If 85% of your SS benefit is not already being taxed, taking $100 out of your IRA makes an additional $85 of your SS benefit taxable so your taxable income will increase $185 and 22% of $185 is $40.70. $40.70 if 40.7% of the $100 that you withdrew. Your actual “Marginal Tax Bracket” would also include your state and local taxes, but I am giving this example for Federal taxes only. Your Marginal tax bracket is the total amount of additional taxes you pay for each additional dollar of income.

Bare with me on this one, it is a bit complex: Dividend and LTCG income is also tax deferred until that income is pushed into the 22% bracket at which time it is then taxed at 15% (that tax rate did not change with the new law).

Let’s say that you are single and your total taxable income plus taxable SS is $38,400 and your tax free dividend income in $300, your total income would be $38,700 which is the start of the 22% bracket. You would be in the 12% bracket at the $38,400 level and 0% for your dividends since they have not crossed the 22% bracket level.

OK, now you withdraw an additional $100 from your taxable IRA which makes an additional $85 of your SSB taxable. Your taxable income increases from $38,400 to $38,585, a $185 increase at 12% which increases your taxes by $22.20. $185 of the $300 of dividends that were below the 22% boundary have also been pushed over the 22% boundary. $115 is still below 22% and are still tax free, and the $185 that was pushed over into the 22% bracket are now taxed at the 15% dividend bracket. 15% of $185 also increases your taxes by an additional $27.75 AND $22.20 plus $27.75 results in a $49.95 tax increase because you withdrew $100 which results in a 49.95% marginal tax bracket.

Any guesses why I am so interested in when my taxable retirement income crosses into the 22% bracket!