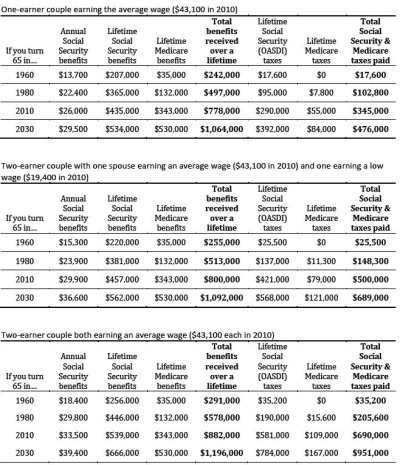

A married couple retiring last year after both spouses earned average lifetime wages paid about $598,000 in Social Security taxes during their careers. They can expect to collect about $556,000 in benefits, if the man lives to 82 and the woman lives to 85, according to a 2011 study by the Urban Institute, a Washington think tank.

Social Security benefits are fading - Brockton, MA - The Enterprise

Part one of a four part series.

Not a good deal, unless something happens (illness, accident, financial loss) on the way to a happy retirement.

Last edited: