Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hi,

I'm interested in knowing how to read or understand what I am buying when buying a treasury bond at a brokerage.

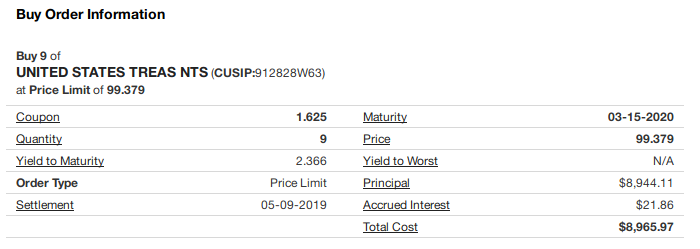

For the example below I read it as:

matures: March 2020

pays interest of: 2.366% which is 1.625% (plus I'm buying it cheaper than $100 and counting the capital gain as interest)

The accrued interest, I'm paying this to the seller, which will make my first payment look extra big for the time I've had it.

I'm buying nine $1,000 bonds in this example.

Anything I've missed or gotten wrong ?

I'm interested in knowing how to read or understand what I am buying when buying a treasury bond at a brokerage.

For the example below I read it as:

matures: March 2020

pays interest of: 2.366% which is 1.625% (plus I'm buying it cheaper than $100 and counting the capital gain as interest)

The accrued interest, I'm paying this to the seller, which will make my first payment look extra big for the time I've had it.

I'm buying nine $1,000 bonds in this example.

Anything I've missed or gotten wrong ?