Hi. I'm sure that I'm going to get a lot of this terminology wrong, but here goes. My husband and I had several old savings bonds mature this year. They were held at Treasury Direct. After they matured, we would get an email saying that the proceeds had been used to purchase a 0% C of I and then I would redeem that to our checking account.

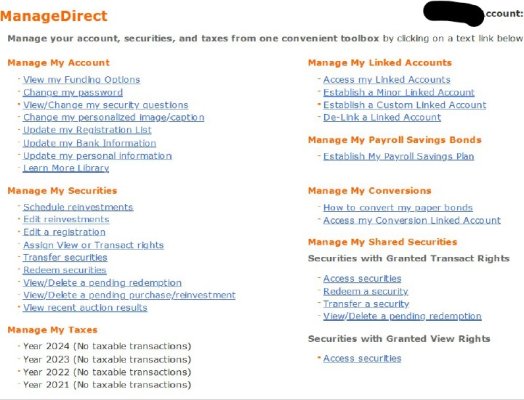

We then get emails that say that our 1099s are available, but when I log in, it says No Taxable Transactions for 2023 under the manage my taxes heading.

Am I looking in the wrong place? This is where the video linked in the email said to get the form.

Any help would be appreciated! Thanks

Linda

We then get emails that say that our 1099s are available, but when I log in, it says No Taxable Transactions for 2023 under the manage my taxes heading.

Am I looking in the wrong place? This is where the video linked in the email said to get the form.

Any help would be appreciated! Thanks

Linda