Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

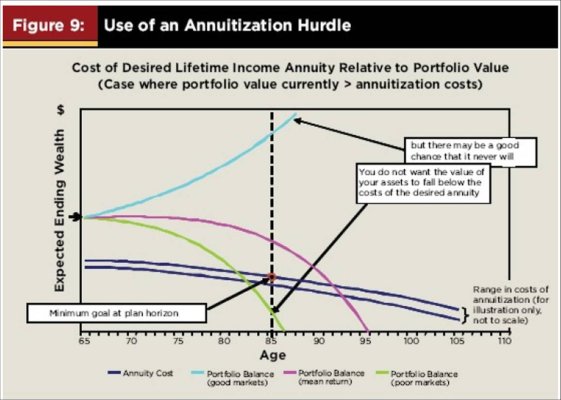

It's not a matter of confident in the long run either, no one can reliably predict that, see graph & link below re: how to determine when/if to annuitize.If you have complete confidence in your AA/portfolio, and ability to maintain a 2.5%-3% WR from here on out, and don't desire to have that diversification "peace of mind" aspect (as well as potentially wanting to maximize the benefit for your estate), then I'd say a SPIA is probably not for you.

For those who aren't anywhere near their annuitization hurdle, waiting is likely to be beneficial. It's unlikely waiting will be "a wash" with just buying an annuity now all else being equal, not with interest rates at historic lows - that's key right now.

http://www.schulmerichandassoc.com/Modern_Portfolio_Decumulation.pdf