Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

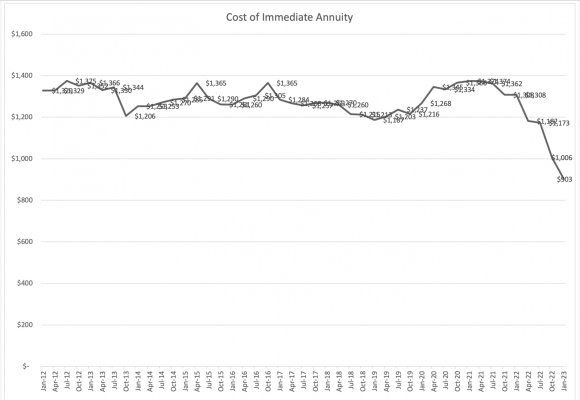

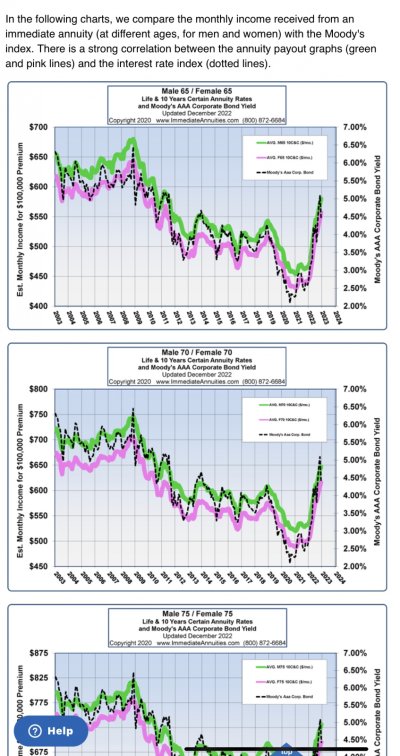

I am NOT planning to buy an annuity, but I've waited a long time to illustrate how age and especially yields can alter the upfront cost of an annuity. The chart shows the cost of an immediate annuity by quarter, for the exact same lifetime monthly payout. Of course an annuity gets cheaper as we age, a case for waiting if possible. And as yields increase, annuities also get cheaper, another case for waiting. With the dramatic increase in interest rates/yields over the last year (finally), you can readily see how waiting (if possible) can pay off substantially.

A SPIA in Jan 2023 costs almost 31% less than in Jan 2022 - for the exact same payout (albeit one year less). FWIW

A SPIA in Jan 2023 costs almost 31% less than in Jan 2022 - for the exact same payout (albeit one year less). FWIW