Travelfreek

Recycles dryer sheets

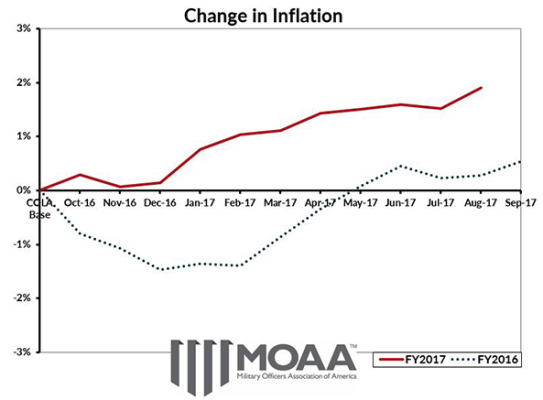

I see the COLA estimate for 2018 is 1.7 % on the low side and 2.2 % on the high side. Works for me (better than .3% in 2017!) .We'll all know for sure by mid October as the final month stats will be in by then. The same COLA applies to fed retirees and military retired! I found the info in Benefit Professionals, Inc. - Building a better future, together. website.

.

.