lssugoalie

Confused about dryer sheets

- Joined

- Jan 18, 2012

- Messages

- 6

Hi all  , I've been stalking this forum for the past couple of weeks and now need some advice.

, I've been stalking this forum for the past couple of weeks and now need some advice.

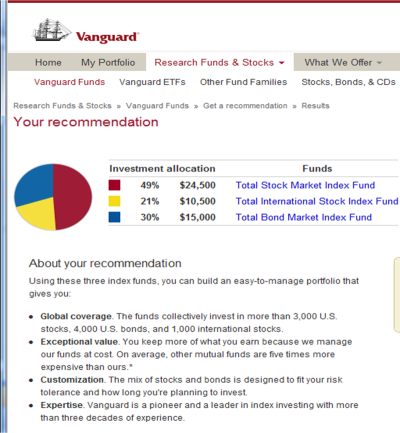

I am 28, hubby is 39. He's the only income at about 110k/year gross. We live way below our means and have been maxing out his TSP and both of our Roth IRAs. When I met him he was with Edward Jones where he was really good friends with the advisor, that advisor left and we were passed on to someone else who, to me, is really shady. He's already tried to sell us a variable annuity, a LIRP?, and is taking big comissions on mutual funds that seem to be stagnant. I want to open a Vanguard account for our Roths, but don't know what to put the money in with such an age difference. Hubby just started this real job 6 years ago and his earliest retirement age is 57, we're shooting for his age 60. I will be transferring from Ed. Jones to Vanguard approx. $15k for me and $22k for him. we will transfer our contributions of $416/month each as well. He will have a gov't pension of approx $3500/month at age 60 plus social security. Any help is much appreciated as he's very hands off with investing so I'm kind of on my own. Thanks.

, I've been stalking this forum for the past couple of weeks and now need some advice.

, I've been stalking this forum for the past couple of weeks and now need some advice.I am 28, hubby is 39. He's the only income at about 110k/year gross. We live way below our means and have been maxing out his TSP and both of our Roth IRAs. When I met him he was with Edward Jones where he was really good friends with the advisor, that advisor left and we were passed on to someone else who, to me, is really shady. He's already tried to sell us a variable annuity, a LIRP?, and is taking big comissions on mutual funds that seem to be stagnant. I want to open a Vanguard account for our Roths, but don't know what to put the money in with such an age difference. Hubby just started this real job 6 years ago and his earliest retirement age is 57, we're shooting for his age 60. I will be transferring from Ed. Jones to Vanguard approx. $15k for me and $22k for him. we will transfer our contributions of $416/month each as well. He will have a gov't pension of approx $3500/month at age 60 plus social security. Any help is much appreciated as he's very hands off with investing so I'm kind of on my own. Thanks.