You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Using fixed pension numbers seems broken?

- Thread starter wzd

- Start date

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

I did a couple of runs using the defaults, changing the annual spending to $40k and adding a $10K annual pension. I got a 92% success rate (8 failures) when I left the inflation adjust box checked, 78% (24 failures) when I unchecked it. Seems OK to me.

Did you select the "pension income" button on the Other Income/Spending tab? The default is "off chart spending" and it is easy to overlook.

Did you select the "pension income" button on the Other Income/Spending tab? The default is "off chart spending" and it is easy to overlook.

Used it for years, so yeah, I did get the box checked right.

Just did the same thing and the numbers do come out differently. The spreadsheet that it exports for 1960 is hosed up though. The top section numbers are correct I think but the pension adjustment shows up as inflation adjusted in both cases. But since the results come out different, I would say it is using it without the inflation adjustment (when the box is not checked) even though it displays it with the inflation adjustment.

However the bottom half with calculations is completely different than the top part.... Probably in part due to the adjustments.

So it is probably working - but the spreadsheet data is not right.

Just did the same thing and the numbers do come out differently. The spreadsheet that it exports for 1960 is hosed up though. The top section numbers are correct I think but the pension adjustment shows up as inflation adjusted in both cases. But since the results come out different, I would say it is using it without the inflation adjustment (when the box is not checked) even though it displays it with the inflation adjustment.

However the bottom half with calculations is completely different than the top part.... Probably in part due to the adjustments.

So it is probably working - but the spreadsheet data is not right.

I reported this in March 2010. It seems the issue has never been fixed nor completely understood. I do not trust black boxes and if the spreadsheet is "Garbage Out" and not representative of what is really going on under the hood, I do not trust the FIREcalc product.

I have switched to Fidelity Retirement Income Planner which I find a much better product (and free).

http://www.early-retirement.org/for...how-non-colad-pensions-are-handled-49054.html

http://personal.fidelity.com/planning/retirement/income_planner.shtml

I should note that the Fido RIP uses a Monte Carlo approach whereas FIREcalc uses a time series approach.

I have switched to Fidelity Retirement Income Planner which I find a much better product (and free).

http://www.early-retirement.org/for...how-non-colad-pensions-are-handled-49054.html

http://personal.fidelity.com/planning/retirement/income_planner.shtml

I should note that the Fido RIP uses a Monte Carlo approach whereas FIREcalc uses a time series approach.

Last edited:

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I reported this in March 2010. It seems the issue has never been fixed nor completely understood. I do not trust black boxes and if the spreadsheet is "Garbage Out" and not representative of what is really going on under the hood, I do not trust the FIREcalc product.

We really should get a answer to this. FIRECALC has too much potential, and is too widely used to have this unknown hanging over it.

As I say in that thread, I think (but cannot know) that the spreadsheet is a separate output, and any errors may or may not indicate errors in FIRECALC itself.

And I'll repeat this line:

Maybe this code needs to be 'open sourced'?

-ERD50

rescueme

Thinks s/he gets paid by the post

If you are a FIDO customer, via a 401k, IRA, or commercial account.I have switched to Fidelity Retirement Income Planner which I find a much better product (and free).

If you are a FIDO customer, via a 401k, IRA, or commercial account.

Not so.

I just tried it without logging in, and you can use if you become a "Fidelity Member Lite", which is different to being a customer. I just registered as a member under a different name and have full access to the Retirement Income Planner.

rescueme

Thinks s/he gets paid by the post

Interesting. It wasen't that way when I started using it about a decade ago.Not so.

I just tried it without logging in, and you can use if you become a "Fidelity Member Lite", which is different to being a customer. I just registered as a member under a different name and have full access to the Retirement Income Planner.

However, can you use Full View as input?

Interesting. It wasen't that way when I started using it about a decade ago.

However, can you use Full View as input?

Yes. It looks just the same as when I use it. (I've also used it for as long as its been around).

Attachments

Rustward

Thinks s/he gets paid by the post

- Joined

- Apr 19, 2006

- Messages

- 1,684

If you are a FIDO customer, via a 401k, IRA, or commercial account.

I don't think you even have to have an account to use RIP. You do have to create a userid and password, though. I use RIP there without having an account.

Rustward

Thinks s/he gets paid by the post

- Joined

- Apr 19, 2006

- Messages

- 1,684

Yes. It looks just the same as when I use it. (I've also used it for as long as its been around).

However, last time I checked you do have to have an account to use FullView. The rep told me I could open an account with $0.01.

rescueme

Thinks s/he gets paid by the post

No, that's the budget main (single/detail input) screen.Yes. It looks just the same as when I use it. (I've also used it for as long as its been around).

Full view is the product (actually, it's Yodlee under the cover) that takes all accounts (both you and spouse, if you wish) from whatever vendor (e.g. FIDO, VG, etc.) and passes the data to Morningstar to get your holdings actual breakdown based upon current M* holding information that they maintain.

That is ported directly to RIP, by running (refreshing) FV first and then running RIP.

For me, the FV -> M* -> RIP is very important, rather than just plugging in "guesstimates" for actual holdings.

rescueme

Thinks s/he gets paid by the post

That would make sense. If you had a cash account at FIDO (such as an IMA account, as I use as a taxable MM holding), you could add external accounts from whatever non-FIDO accounts you maintain.However, last time I checked you do have to have an account to use FullView. The rep told me I could open an account with $0.01.

Last edited:

No, that's the budget main (single/detail input) screen.

Full view is the product (actually, it's Yodlee under the cover) that takes all accounts (both you and spouse, if you wish) from whatever vendor (e.g. FIDO, VG, etc.) and passes the data to Morningstar to get your holdings actual breakdown based upon current M* holding information that they maintain.

That is ported directly to RIP, by running (refreshing) FV first and then running RIP.

For me, the FV -> M* -> RIP is very important, rather than just plugging in "guesstimates" for actual holdings.

Gotcha. Thanks.

Other than FIDO I only have VG, and after I had inputted the ticker symbols and # of shares for the 3 funds at VG that make up my RE then the projections and analysis are accurate enough for me. I usually run it 2 or 3 times a year at which time I update the numbers of VG shares plus the value of my I-Bonds.

I might try FV to automate the VG updates, but it really is not that much effort to input 3 sets of numbers 2 or 3 times a year.

One question - I do have a ROTH IRA at VG that is excluded from my retirement income calculations as it is my LTC fund which I pay into each year and is itemized as an expense. Does FV allow you to specify which funds from the brokerages you set up in it?

We really should get a answer to this. FIRECALC has too much potential, and is too widely used to have this unknown hanging over it.

As I say in that thread, I think (but cannot know) that the spreadsheet is a separate output, and any errors may or may not indicate errors in FIRECALC itself.

And I'll repeat this line:

Maybe this code needs to be 'open sourced'?

-ERD50

I'd have to agree with you. I looked over the numbers and results and the actual results appear to be accurate but the spreadsheet appears incorrect. But being able to review a spreadsheet helps me establish my trust that the tool is doing what I want, so fixing it would be a very good thing. My previous offer to work on fixing bugs like this one stands.

I've used T. Rowe Price and Fidelity tools and have to say the flexibility in Firecalc makes it better for me. The only way to adjust future spending at age 70/75/80 in the Fidelity tools was to add a fake annuity starting at those years to cover 15% of expenses. Kind of a kludgey way to do it.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Clearly not a company man.However, last time I checked you do have to have an account to use FullView. The rep told me I could open an account with $0.01.

The only way to adjust future spending at age 70/75/80 in the Fidelity tools was to add a fake annuity starting at those years to cover 15% of expenses. Kind of a kludgey way to do it.

Not true. You can do "Detailed Budget" and change budget items at will throughout your retirement. Even more accurate than a macro adjustment.

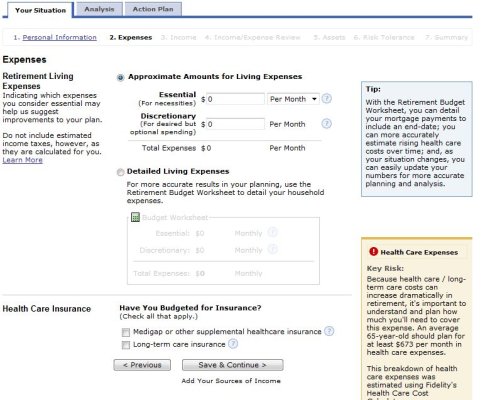

On the second page "Expenses" click the radio button marked "Detailed Living Expenses" (rather than "Approximate Amount for Living Expenses". You can change each category year by year if you wish. Ultimate in flexibility and I believe FIDO RIP inflates health care expenses at a higher rate than general expenses so should be more accurate.

Last edited:

Similar threads

- Replies

- 8

- Views

- 665

- Replies

- 7

- Views

- 850