Telly

Thinks s/he gets paid by the post

- Joined

- Feb 22, 2003

- Messages

- 2,395

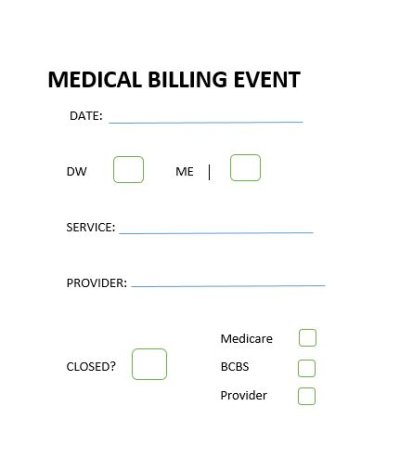

I'm a Medicare newby, and wonder what others are doing here with regards to any personal record keeping, for those on Original Medicare (NOT a MA Plan).

For 40+ years of health insurance plans, DW has kept track of what we paid, when, to who, what the insurance co. picked up, what the state of our deductibles were, etc. This was on paper originally, until we got our first home PC (a 286 machine) and went to a spreadsheet. When I was on my own separate insurance for intervals in the past, I did the same.

Now I've transitioned to Original Medicare, all the EOB-equivalents are online and spread across three different entities. Printing out some of them that are PDFs would be easy, those that are not would require the cutting tool to avoid creating a paper monster.

Are you doing any sort of separate record keeping system? Or just looking at what's online? Are you keeping a scratch pad on deductibles? I have no experience with this!

For 40+ years of health insurance plans, DW has kept track of what we paid, when, to who, what the insurance co. picked up, what the state of our deductibles were, etc. This was on paper originally, until we got our first home PC (a 286 machine) and went to a spreadsheet. When I was on my own separate insurance for intervals in the past, I did the same.

Now I've transitioned to Original Medicare, all the EOB-equivalents are online and spread across three different entities. Printing out some of them that are PDFs would be easy, those that are not would require the cutting tool to avoid creating a paper monster.

Are you doing any sort of separate record keeping system? Or just looking at what's online? Are you keeping a scratch pad on deductibles? I have no experience with this!