- Joined

- Oct 13, 2010

- Messages

- 10,763

You're 64 and you've decided that Traditional Medicare plus a Medicare Supplement plan is the way to go. Now you need to find a medigap plan.

The first step is to go to Medicare.gov "Find a Medicare Supplement Insurance (Medigap) policy" and get a list of companies that offer plans in your zip code.

Regardless of your health status, you now know what the prices are, but since you're probably going to be stuck with this insurance coverage until your last breath, you want to know the pricing for all years, not just this year. Of course this is impossible to know, but what you can know is what each of these insurance companies have done in the past (as an indication of what they will do in the future). Two things you want to know:

These two questions can also be answered if you want to spend many hours researching it yourself on the SERFF site [ https://www.serff.com/serff_filing_access.htm ]. Getting specifics out of that site is beyond the scope of this post, but it's the source of the data attached. The heavy lifting was done by they guy at this YouTube channel: https://www.youtube.com/@GiardiniMedicare and on that channel, you can also find guidance to finding what you need on the SERFF site.

The reason for this post is to show some examples of rate increases by policy issuer. Notice I didn't say rate increases by "company", because one company might open a policy issuing entity and maybe closes the book on that entity or maybe doesn't close the book on it. That information tends to be critical for not getting stuck in a "sick duck pool".

Briefly, what can happen if you buy a medigap policy from one of these companies known to "close the book", is that as the population who are paying premiums for the policy age, they tend toward higher utilization (spend more medical dollars) and so the rates start to go up. Then, and this is the critical part, the healthy people, not liking the rate increases and knowing they can pass underwriting, shop for a cheaper policy, which they can easily find. When they do, they "fly away" from the pool, leaving a higher proportion of sicker people, resulting in the "sick duck pool" with rates that spiral higher and higher. If you're healthy and can pass underwriting, you'll fly too! But every one of us is one scan, one polyp, one blood test away from not being able to pass underwriting.

So although the following slides came from companies offering plans in Michigan, many of the "companies" do business in other states, and probably do business in a similar manner.

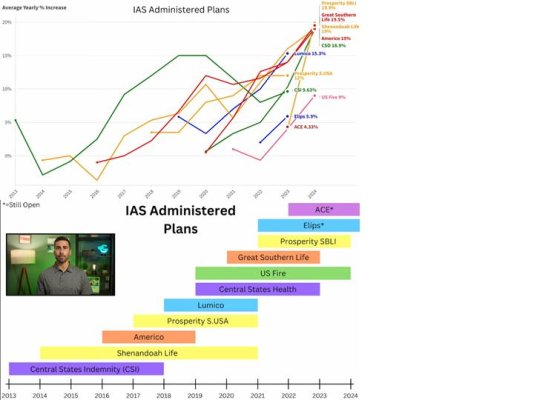

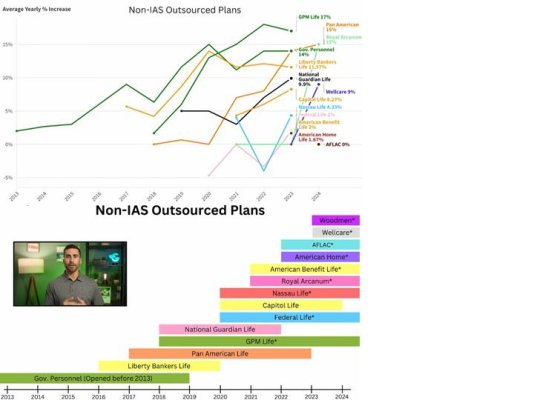

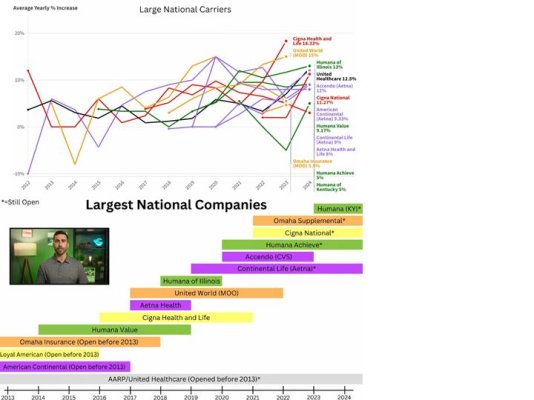

The graphics below were collected from a pretty long video on Giardini's YouTube channel. Note that "IAS" is a company that manages the interface between an insurance company and both the customers and the state regulators. So an insurance company doesn't need expertise or staff that's steeped in the rules and regulations of Medicare Supplement law...they outsource the whole works.

One thing you can take-away from these graphs is that the sampled IAS administered plans usually last 3 years before they close the book, and the annual percentage increases go up quite a bit.

I encourage you to find the "Hidden Truth..." video and watch it to get a better idea of what's in these graphs.

Best luck in your Medicare Supplement Plan shopping analysis!

The first step is to go to Medicare.gov "Find a Medicare Supplement Insurance (Medigap) policy" and get a list of companies that offer plans in your zip code.

Regardless of your health status, you now know what the prices are, but since you're probably going to be stuck with this insurance coverage until your last breath, you want to know the pricing for all years, not just this year. Of course this is impossible to know, but what you can know is what each of these insurance companies have done in the past (as an indication of what they will do in the future). Two things you want to know:

- Does this insurance company have a history of "Closing the Book"

- What is this insurance company's rate increase history look like?

These two questions can also be answered if you want to spend many hours researching it yourself on the SERFF site [ https://www.serff.com/serff_filing_access.htm ]. Getting specifics out of that site is beyond the scope of this post, but it's the source of the data attached. The heavy lifting was done by they guy at this YouTube channel: https://www.youtube.com/@GiardiniMedicare and on that channel, you can also find guidance to finding what you need on the SERFF site.

The reason for this post is to show some examples of rate increases by policy issuer. Notice I didn't say rate increases by "company", because one company might open a policy issuing entity and maybe closes the book on that entity or maybe doesn't close the book on it. That information tends to be critical for not getting stuck in a "sick duck pool".

Briefly, what can happen if you buy a medigap policy from one of these companies known to "close the book", is that as the population who are paying premiums for the policy age, they tend toward higher utilization (spend more medical dollars) and so the rates start to go up. Then, and this is the critical part, the healthy people, not liking the rate increases and knowing they can pass underwriting, shop for a cheaper policy, which they can easily find. When they do, they "fly away" from the pool, leaving a higher proportion of sicker people, resulting in the "sick duck pool" with rates that spiral higher and higher. If you're healthy and can pass underwriting, you'll fly too! But every one of us is one scan, one polyp, one blood test away from not being able to pass underwriting.

So although the following slides came from companies offering plans in Michigan, many of the "companies" do business in other states, and probably do business in a similar manner.

The graphics below were collected from a pretty long video on Giardini's YouTube channel. Note that "IAS" is a company that manages the interface between an insurance company and both the customers and the state regulators. So an insurance company doesn't need expertise or staff that's steeped in the rules and regulations of Medicare Supplement law...they outsource the whole works.

One thing you can take-away from these graphs is that the sampled IAS administered plans usually last 3 years before they close the book, and the annual percentage increases go up quite a bit.

I encourage you to find the "Hidden Truth..." video and watch it to get a better idea of what's in these graphs.

Best luck in your Medicare Supplement Plan shopping analysis!