NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

... The demand to stay [-]healthy and[/-] alive simply overwhelms the supply.

Fix it for you.

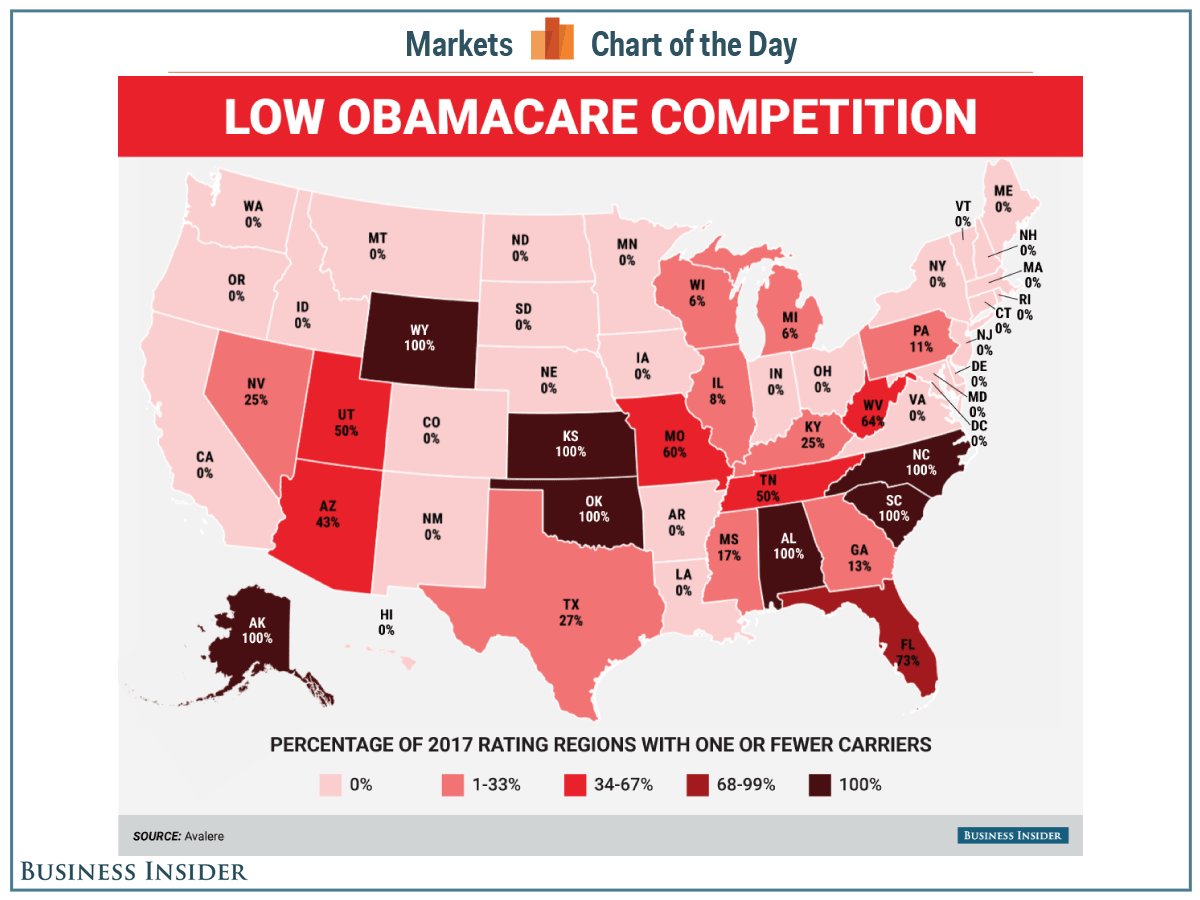

I forgot something. That is, the profit margin of health insurers may vary quite a bit between ACA plans and their other operations involving Medicare and Medicaid. I have seen reports saying they are making better money outside of ACA. If your business is making more money in one area than the other, would you not drop the money losing side to work more on the juicy side?

Makes me wonder how better they would do if Uncle Sam takes over everything. I should be buying their stocks. If you cannot beat them, then join them.

Oh wait! Who wants the insurers? I want to invest in the healthcare providers. That's where the bulk of money is flowing.

Oh wait again. Aren't most hospitals "non-profit" organizations? They manage to spend all the money, so there's no profit left.

And they even have the gall to run charity drive.

And they even have the gall to run charity drive. Son of a gun! How can I join in the loot?

Last edited: