target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

https://finance.yahoo.com/news/vanguard-recommends-investors-increase-non-013404803.html

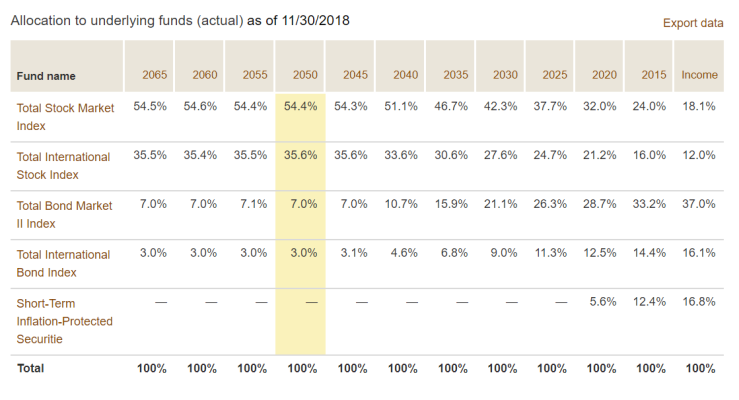

Vanguard has increased their recommended allocation in foreign stocks to 40%, up from 30%.

Bogle just got in his car and is on his way to corporate headquarters...

Vanguard has increased their recommended allocation in foreign stocks to 40%, up from 30%.

Bogle just got in his car and is on his way to corporate headquarters...