CuppaJoe

Moderator Emeritus

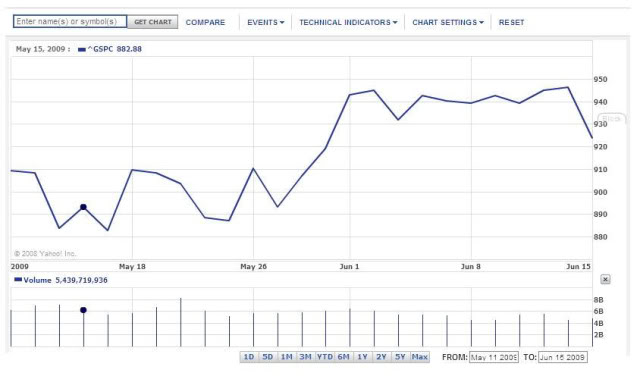

I bought a chunk of S&P index on 6/9. Past performance indicates there will be an immediate dip, a nice buying opportunity, then there will be fluctuations.

Always interesting to follow up on market prognostications...

5/9: I think the bear market rally is over. I think next week will be the beginning of a downturn

5/10: The rally is over. The downturn will start this week.

5/16: Downturn will continue for the next 4 weeks

5/16: Yeah, my crystal ball is great....downturn to continue for about a month

Four and half weeks later, S&P 500:

Fortunately, I'm not planning on hitting it big based on my newsletter subscriptionsSure. Just don't expect me to subscribe to your newsletter.

Well, I surely wouldn't rule anything out.

Just one or two more Wh*** drive-by postings and TSL will have her wish.

Hey, it's the lady with the crystal ball. I realize the downturn has been an upturn; however, my last post said downturn to continue for about a month. The month ends on 16 June. Can you at least give me until then to see where we're at? Anything's possible in this market!

Yes, I'm here. Downturn will continue for the next 4 weeks.

What is your next prediction?Yeah, my crystal ball is great....downturn to continue for about a month.

Per your request, it is now market close on June 16:

What is your next prediction?

from me>

from me>He placed the order last night and it should process this evening after market close.

About TSL, what if her market call is simply delayed by a month?

you do know someone else can toss in a pssst - Wellesley once in a while.

you do know someone else can toss in a pssst - Wellesley once in a while. She said the downturn was over.

Magic 8 Ball.Where? Is it a public post, or by PM?

How long will the downturn last?It's the lady with the crystal ball. Looks like my timing was a month off. Here comes the downward trend.

How long will the downturn last?

I'm too lazy to redo the graph, but we'll mark the starting point for your mulligan at 912.First, can you repost your graph? It shows through market close yesterday. The S&P closed at 911.97 today.

Second, I see it lasting about 4 weeks.

You should have stayed with the original graph's (higher) ending point to start your four-week downturn prediction, SL