So you don't care what kind of streak I'm on and you have no respect for the length of the contest. You're always going to find something. If I was in first place you'd probably complain that the contest isn't long enough. Actually I think I've heard that complaint.

Sigh.

I've been consistent all through this. I've said the contest, while fun for some, won't 'prove' anything one way or the other - sample size too small, too short of a time period.

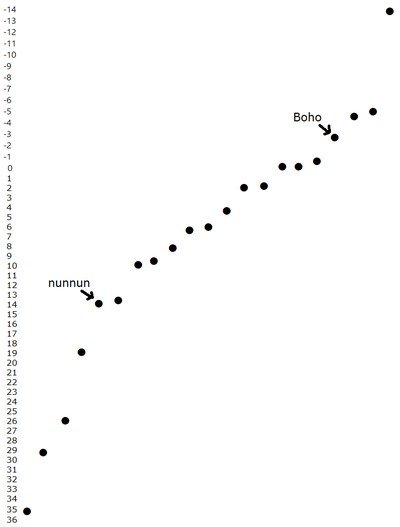

What I've said I do expect is that most of the stock pickers will see more volatility than "the market" (so far represented by nunnun). I expect some pickers will do better than the market, some worse. If you do a bit of study, I think you'd agree. It's really the only thing we can expect.

So far, the stock pickers are mostly doing worse than I would have expected, monkeys/darts would have at least put the nunnun portfolio in the middle.

"Streaks" mean nothing. That's bar-room trash-talk, not investing. Anyhow, the "streak" you brag about is worse than what the market did in that period. That's the best you got? So keep it up, and you'll just keep falling further and further behind. That should be obvious, it's simple arithmetic.

Are you having fun?

edit/add: If you wanted to impress me, you needed to

get ahead of the nunnun portfolio,

and stay ahead. Anything else isn't worth the time of day.

-ERD50