ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just want to say that it's the wildfires in California that caused RNR to drop after I bought it. It's not my fault.

I'm beginning to think you are just trolling us (well, actually, I've thought it for a while, all the way back to your "Rock, Paper, Scissors" posts, but giving the benefit of the doubt).

Of course it is your fault! You bought it!

Whenever you buy an individual stock, you take specific stock risk (and specific stock reward). This is greatly reduced through diversification (see nun for advice on this!).

Let me guess, when your pick goes up, it was because of your superior stock picking skills, but when it goes down, it was due to something beyond your control?

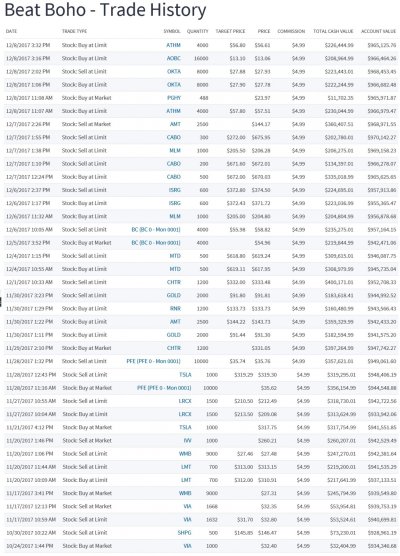

Sure wish we could get an up-to-date comparison, since it seems portfolios are not updated at the same time. Though that will become less important over time. As I said before, with a small sample size and relatively short time frame, anything can happen. But things seem to be playing out as expected - a lot of volatility among the stock pickers, and starting to look like very few of them can stay ahead of a broad buy/hold strategy. As if we needed more 'proof'?

-ERD50