Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

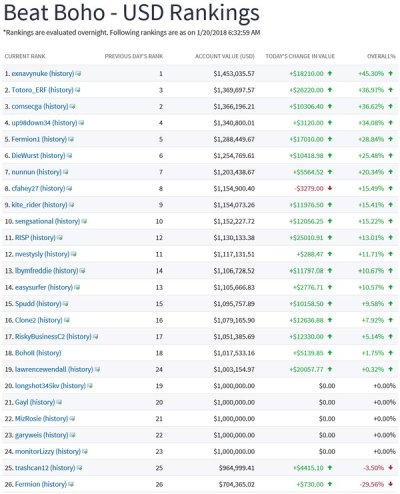

So even when you end up with a winning stock, your timing doesn't get you any better than the market did (while nunnun napped). It's uncannily, almost exactly the same as market returns:

-ERD50

I think that's pretty good in a strong market. As I said:

I think I should do as well as the S&P when the market is up and somewhat better when the market is down. That's if I continue trading as much as I have been in recent weeks.