easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,155

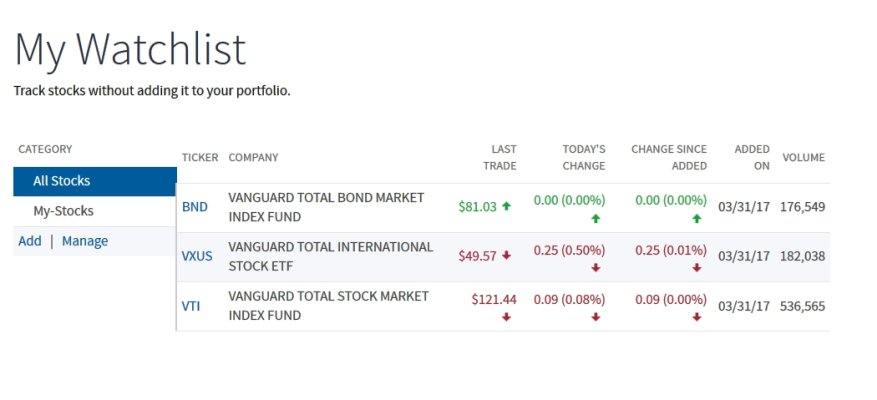

I ran into the "diversification rule" so I could only buy $500k of VTI.....I just bought VOO with my remaining $500k.

Good idea!

Ah yes, those checks and balances.

I'm sitting in cash enjoying the virtual scent of my virtual $1M at this time.