- Joined

- Oct 13, 2010

- Messages

- 10,766

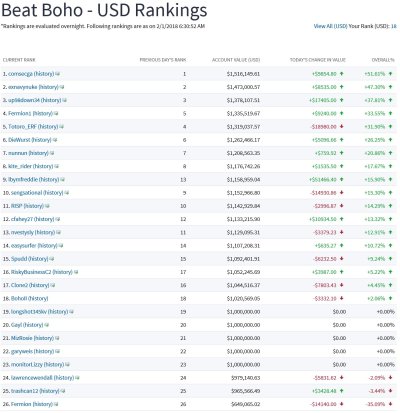

You have my vote for the most likely to win the game.

Player|Rank|Stock|Start|Start$|End|End/Now$|Gain/Loss

Totoro_ERF|

|

|

|

|

|

Totoro_ERF|

2

|

DB

|

03/30/2017

|

184,076

|

05/30/2017

|

195,516

|

6%

||

|

AER

|

05/30/2017

|

223,350

|

Open

|

270,550

|

21%

||

|

AER

|

05/30/2017

|

265,080

|

Open

|

324,660

|

22%

||

|

BKE

|

05/30/2017

|

68,200

|

Open

|

83,000

|

22%

||

|

MIK

|

05/30/2017

|

234,480

|

Open

|

312,120

|

33%

||

|

PII

|

05/30/2017

|

252,570

|

Open

|

404,100

|

60%

|