ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Regarding the top 4, for 2010, dec 2009 info was used, for 2011 dec 2010, etc.

...

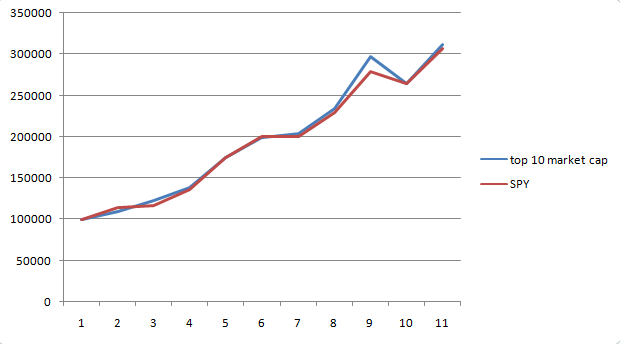

For those top 4, it worked out well for 2010-2018 since they didn’t change, if there is change in the top 4, I’m sure performance will go down quick. ...

top 1 to 10

Dec-09 XOM MSFT WMT GOOG AAPL JNJ PG IBM T JPM

Dec-10 XOM AAPL MSFT BRK-A GE WMT GOOG CVX IBM PG

Dec-11 XOM AAPL MSFT IBM CVX GOOG WMT BRK-A GE PG

Dec-12 AAPL XOM GOOG WMT MSFT BRK-A GE IBM CVX JNJ

Dec-13 AAPL XOM GOOG MSFT BRK-A GE JNJ WMT CVX WFC

Nov-14 AAPL MSFT XOM GOOG BRK-A JNJ WMT WFC GE PG

Dec-15 AAPL GOOG MSFT BRK-A XOM AMZN FB GE JNJ WFC

Dec-16 AAPL GOOG MSFT BRK-A XOM AMZN FB JNJ JPM GE

Dec-17 AAPL GOOG MSFT AMZN FB BRK.B JNJ JPM XOM BAC

Dec-18 MSFT AAPL AMZN GOOG BRK.A FB JNJ JPM V XOM

I'm not following you. What do you mean the top 4 did not change? Your table says they did change. And even if you meant "did not drop out of the top 4" or "the top 10", that doesn't seem true either.

I'm confused. What allocation of those 4 ( XOM MSFT WMT GOOG I assume?) did you use for you chart?

-ERD50