TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

In case you are considering switching from Quicken to MD, here's been my experience so far...

I recently took another look at alternatives to Quicken, since I was so frequently annoyed at how Intuit could get away with releasing an app that had so many problems. Even if another app has less features, it could be more relaxing to use.

After my first look at Moneydance, I decided it was too primitive. I took a second look, and it grew on me. Also, I found that their tech support is excellent, and got answers to questions on their forum quickly, even on a Sunday.

REPORTS AND GRAPHS COMPARISON

The main things I do with my financial app is check my spending, look at performance of my different funds, and look at net worth over time.

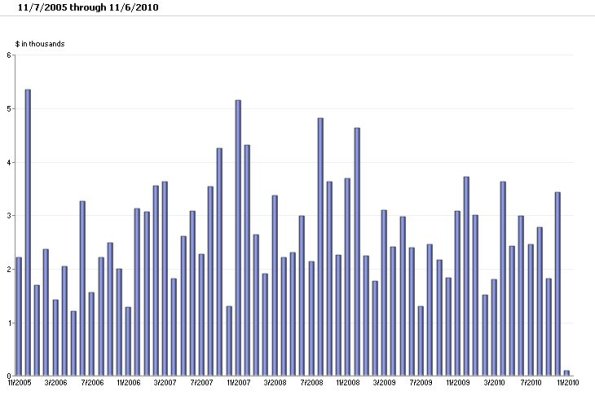

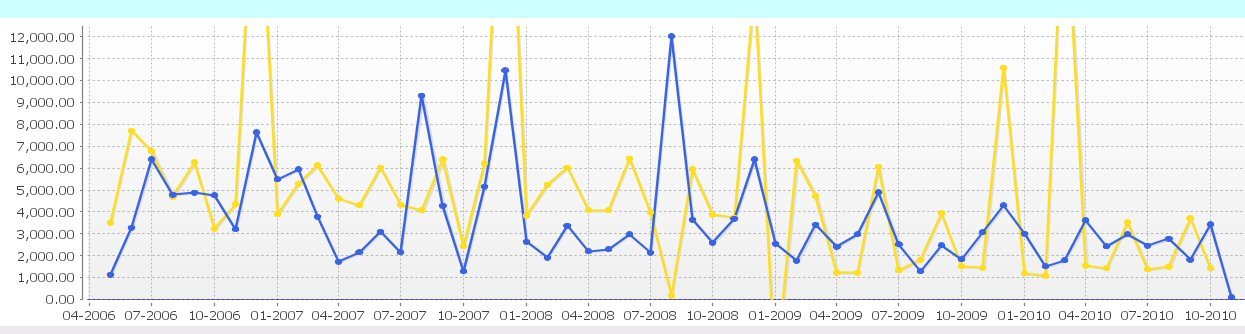

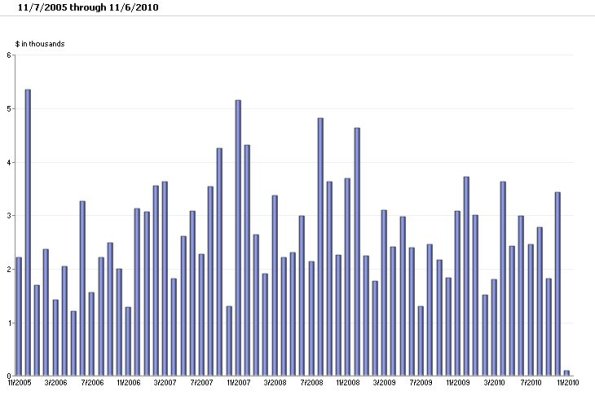

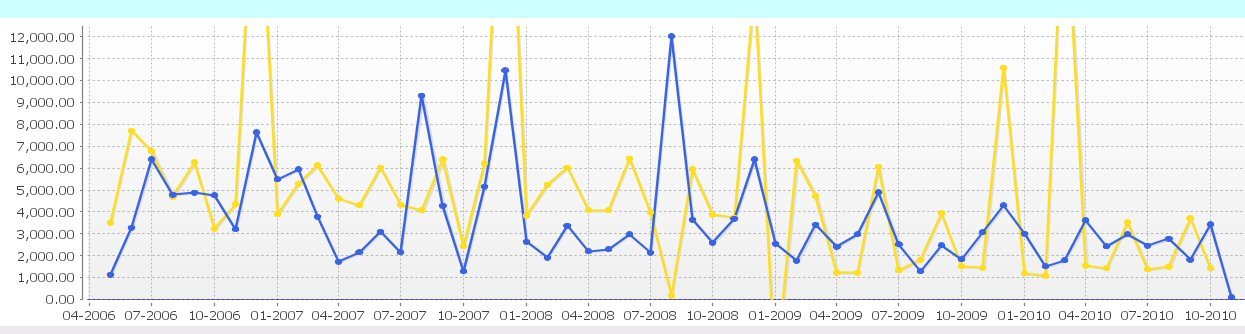

Here's the spending graph for the two (ignore the yellow line in the MD graph):

You cannot filter as easily based on the text in the description field, but MD has a much better system of tags than does Quicken.

There's no performance graph in MD, but you can prepare a performance report. I liked Quicken's graph, since you could see at a glance how the different funds were performing.

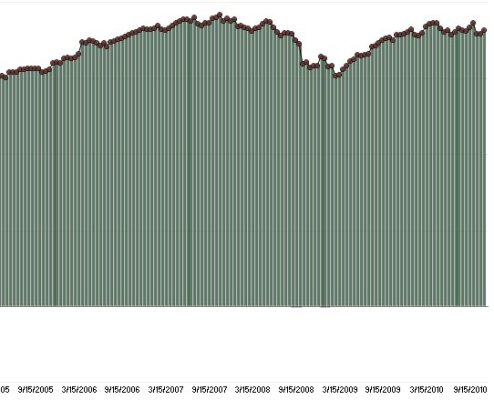

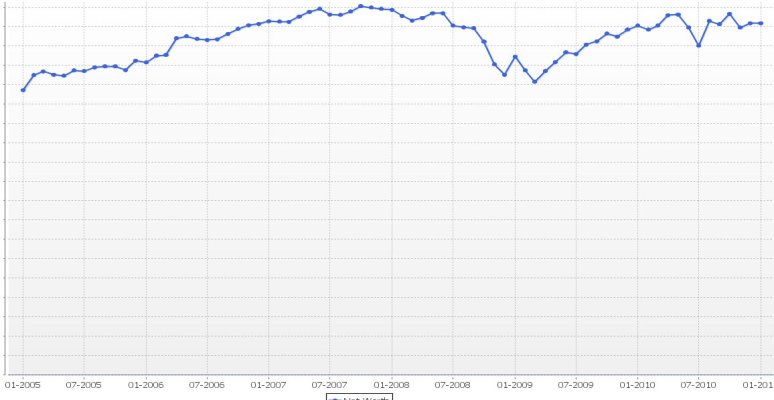

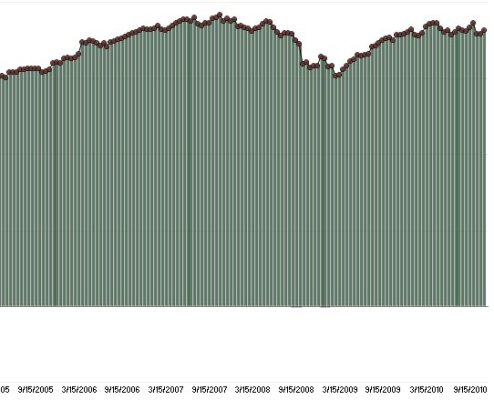

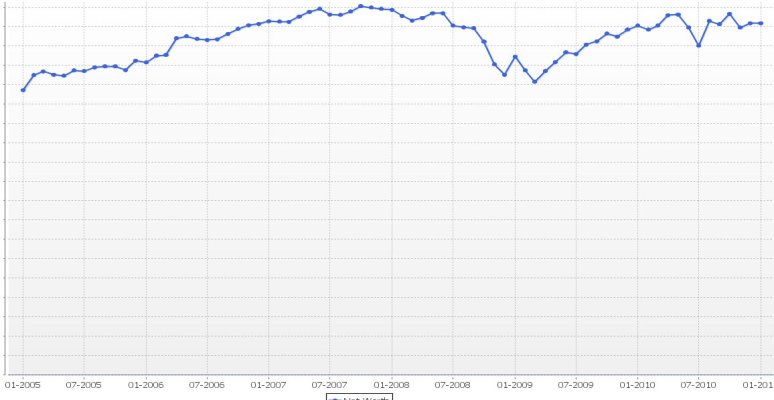

Here's the net worth vs. time graph for the two apps:

Quicken has a way of storing reports in different categories, whereas all MD's reports are in one place. You can of course use names to categorize them (e.g. "TAX: Knitting Income Report"). This is an example of how MD is simpler. Quicken had a bug in which things got saved to the wrong folder, and saving a report could give it a new name.

CONVERTING FROM QUICKEN

I've used Quicken since 1991. There were many file corruptions and rebuilds. At one point I eliminated all data prior to some dates in an effort to fix some bugs and slow loading (it didn't fix them). I think that this was the reason that the conversion to MD was not simple.

I've learned that the conversion problems lie on Quicken's end. One user reported exporting from Quicken and then importing back in to Quicken and having the same problems I found.

In any case, here's how it went for me. I exported from Quicken (to a QIF file), and imported into MD. All of my accounts and categories were there. However, the balances were not correct on most accounts.

The main problem was that for many transactions, transfers from one account to another was duplicated. For example, if I moved $10,000 from the Total Stock fund to the 500 Index fund, I'd see one BUYXfr transaction (that is purchase stock using funds from the Total Stock Fund) and another Xfr transaction (that is, transfer $10,000 to the cash account of the 500 Index fund). As a result of this duplication, the Index would have a cash balance of $10,000 instead of zero.

The other problem was related to the accounts which, in Quicken, I had eliminated older transactions. When these were imported into MD, the source of the funds for those transactions came from the cash balance instead.

To fix these, I put Quicken in one window and MD in another, and went through the accounts (about 40 altogether -- many of which have been closed long ago), and if the balances didn't agreed, I looked for the problems described above. For most accounts there were only one or two problems.

Bottom line, figuring out what the problems were, asking and getting answers to questions on the MD forum, learning the app, and making the changes, took me 4-6 hours of work to get the accounts total to match what it was in Quicken. It would have been easier if the tech support team had a document that describes all the problems one might encounter along with their solutions.

It wasn't as tedious as it sounds, and it was rewarding as each account was solved.

WHERE I GO FROM HERE

I was planning to run Quicken and MD in parallel until 1/1/2011, but now that I have the data in MD, I see no reason to do that.

Bottom line: MD seems simpler, but more straightforward. They have a responsive tech support team. I haven't yet encountered the kind of bugs and inconsistencies that were so common in Quicken.

I recently took another look at alternatives to Quicken, since I was so frequently annoyed at how Intuit could get away with releasing an app that had so many problems. Even if another app has less features, it could be more relaxing to use.

After my first look at Moneydance, I decided it was too primitive. I took a second look, and it grew on me. Also, I found that their tech support is excellent, and got answers to questions on their forum quickly, even on a Sunday.

REPORTS AND GRAPHS COMPARISON

The main things I do with my financial app is check my spending, look at performance of my different funds, and look at net worth over time.

Here's the spending graph for the two (ignore the yellow line in the MD graph):

You cannot filter as easily based on the text in the description field, but MD has a much better system of tags than does Quicken.

There's no performance graph in MD, but you can prepare a performance report. I liked Quicken's graph, since you could see at a glance how the different funds were performing.

Here's the net worth vs. time graph for the two apps:

Quicken has a way of storing reports in different categories, whereas all MD's reports are in one place. You can of course use names to categorize them (e.g. "TAX: Knitting Income Report"). This is an example of how MD is simpler. Quicken had a bug in which things got saved to the wrong folder, and saving a report could give it a new name.

CONVERTING FROM QUICKEN

I've used Quicken since 1991. There were many file corruptions and rebuilds. At one point I eliminated all data prior to some dates in an effort to fix some bugs and slow loading (it didn't fix them). I think that this was the reason that the conversion to MD was not simple.

I've learned that the conversion problems lie on Quicken's end. One user reported exporting from Quicken and then importing back in to Quicken and having the same problems I found.

In any case, here's how it went for me. I exported from Quicken (to a QIF file), and imported into MD. All of my accounts and categories were there. However, the balances were not correct on most accounts.

The main problem was that for many transactions, transfers from one account to another was duplicated. For example, if I moved $10,000 from the Total Stock fund to the 500 Index fund, I'd see one BUYXfr transaction (that is purchase stock using funds from the Total Stock Fund) and another Xfr transaction (that is, transfer $10,000 to the cash account of the 500 Index fund). As a result of this duplication, the Index would have a cash balance of $10,000 instead of zero.

The other problem was related to the accounts which, in Quicken, I had eliminated older transactions. When these were imported into MD, the source of the funds for those transactions came from the cash balance instead.

To fix these, I put Quicken in one window and MD in another, and went through the accounts (about 40 altogether -- many of which have been closed long ago), and if the balances didn't agreed, I looked for the problems described above. For most accounts there were only one or two problems.

Bottom line, figuring out what the problems were, asking and getting answers to questions on the MD forum, learning the app, and making the changes, took me 4-6 hours of work to get the accounts total to match what it was in Quicken. It would have been easier if the tech support team had a document that describes all the problems one might encounter along with their solutions.

It wasn't as tedious as it sounds, and it was rewarding as each account was solved.

WHERE I GO FROM HERE

I was planning to run Quicken and MD in parallel until 1/1/2011, but now that I have the data in MD, I see no reason to do that.

Bottom line: MD seems simpler, but more straightforward. They have a responsive tech support team. I haven't yet encountered the kind of bugs and inconsistencies that were so common in Quicken.