Debinnov a

Recycles dryer sheets

- Joined

- Nov 2, 2013

- Messages

- 238

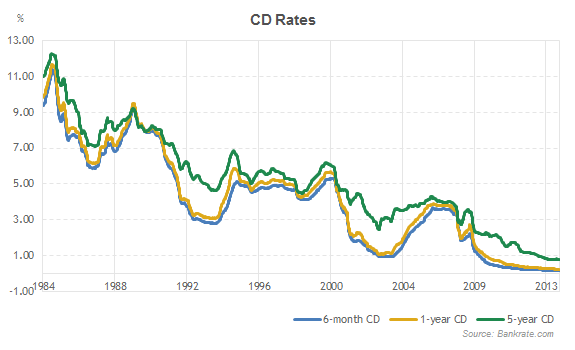

I may soon have about $1,500,000 to invest in CD's for my early retirement (in addition to liquid emergency and immediate living costs and a small percentage in stock index funds. The plan is for retirement in 2014.

My issue is that the online cd laddering calculators that I have found ALL want to divide the total amount for me. I don't want $300,000 in each CD. I want to put the bulk (most) of it in a higher interest 5 year CD and then have the 1 - 4 year CD's be just enough so that there is money becoming available every year if needed.

Does anyone know of a site or have a spreadsheet designed so that the amount put in the ladder doesn't have to be your total investment divided by 5?

Thanks

My issue is that the online cd laddering calculators that I have found ALL want to divide the total amount for me. I don't want $300,000 in each CD. I want to put the bulk (most) of it in a higher interest 5 year CD and then have the 1 - 4 year CD's be just enough so that there is money becoming available every year if needed.

Does anyone know of a site or have a spreadsheet designed so that the amount put in the ladder doesn't have to be your total investment divided by 5?

Thanks