Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

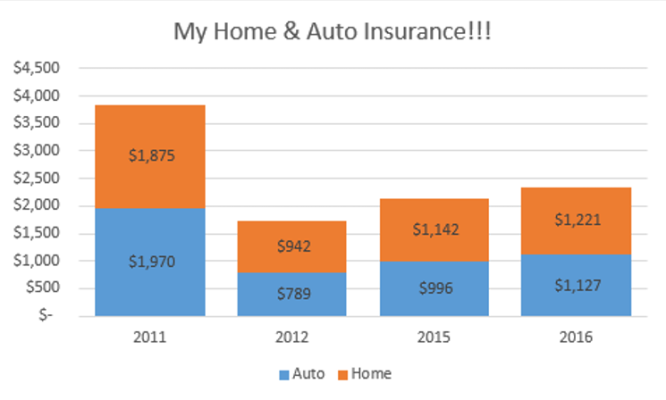

I found out I was being ripped off by my friendly insurance provider back in 2011-12, despite 1 auto claim & ZERO homeowners claims in 30 years, that story was here http://www.early-retirement.org/forums/f27/hopefully-theres-no-one-as-dumb-as-me-here-59422.html. The only reason they didn't get booted then and there is because they gave me lower rates than any other reputable company.

Since then I have gotten new quotes every year to 'keep them honest,' but it seems I can't win anyway. My rates have gone up way more than COL every year, this year I get to pay 7% for homeowners (same house) and 13% more for auto (same cars, with another year of depreciation).

[/rant]

Since then I have gotten new quotes every year to 'keep them honest,' but it seems I can't win anyway. My rates have gone up way more than COL every year, this year I get to pay 7% for homeowners (same house) and 13% more for auto (same cars, with another year of depreciation).

[/rant]

Attachments

Last edited: