street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,539

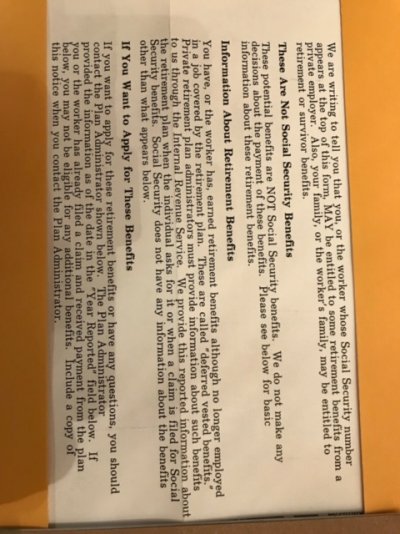

So today I got this letter from SS Adm. and this letter is about a 401K I still have and have not taken any money from this 401K. Can someone explain to me what this means and is there anything I need to do? I'm a lttle confused with what they are trying to tell me. I did enroll for SS which I will get my first check in February.

Here is what the letter stated minus the Financial Institution and of coarse the amount. Sorry but I can't get it to rotate.

http://www.early-retirement.org/forums/attachment.php?attachmentid=29966&stc=1&d=1543023659

Here is what the letter stated minus the Financial Institution and of coarse the amount. Sorry but I can't get it to rotate.

http://www.early-retirement.org/forums/attachment.php?attachmentid=29966&stc=1&d=1543023659