heeyy_joe

Thinks s/he gets paid by the post

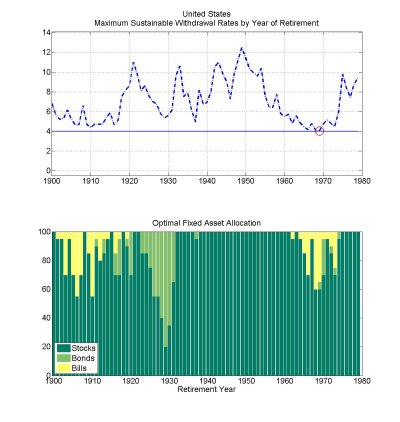

For those of you unsure of a 4% withdrawl strategy, here is an article for you.

David Ning runs MoneyNing, a personal finance site that shares money moves you can make to significantly increase your chances of having a comfortable retirement. Here is a USNEWS and World report article:

Why 4 Percent Annual Withdrawals are Still Safe - Yahoo! Finance

Here are a few reasons a 4 percent withdrawal rate could still work for you:

-Safe withdrawal rates are based on the absolute worst case scenario.

-What are the chances you will live to 95?

-You can adjust your spending.

-Look at your budget closely, and there are many things that can be cut.

-Social Security will still serve as a solid foundation.

-Low expected returns won't last forever.

As for me, I think I will stick with a 3% plan until interest rates come back to historical norms.

David Ning runs MoneyNing, a personal finance site that shares money moves you can make to significantly increase your chances of having a comfortable retirement. Here is a USNEWS and World report article:

Why 4 Percent Annual Withdrawals are Still Safe - Yahoo! Finance

Here are a few reasons a 4 percent withdrawal rate could still work for you:

-Safe withdrawal rates are based on the absolute worst case scenario.

-What are the chances you will live to 95?

-You can adjust your spending.

-Look at your budget closely, and there are many things that can be cut.

-Social Security will still serve as a solid foundation.

-Low expected returns won't last forever.

As for me, I think I will stick with a 3% plan until interest rates come back to historical norms.