If Sturm, Ruger & Co. can't be called upon, my old buddy Evan Williams will round up the Percocet boys and get the task done in a jiffy.

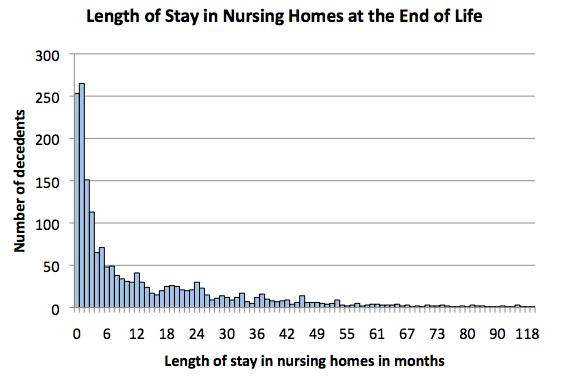

I think that's the plan for many, but in reality, it likely won't work out that way. My FIL had the first of several strokes the day after his wife died after a stroke. He made one daughter promise not to put him in a care facility should the same happen to him. The stroke caused him to lose speech, but he was working on it and was slowly improving. Two months later, he had his second stroke and could no longer walk unassisted. During this two months, both daughters were assisting him with doctor appointments, both having to travel over 5 hours to get where he lived. He refused rehab and as promised, was brought home. We then spent a week doing 24 hour care while trying to arrange competent in-home care. The daughter who made the promise freaked by the third day and put him in a care facility. The day he was to be transported, he had another stroke that fully took away his ability to walk. He's now in a care facility and we're taking turns have a family member with him at all times while he slowly deteriorates.

His original plan was a S&W to the head. Barring that, since he lives in an assisted suicide state, he would have gone that route. But losing the ability to communicate took that option out. And don't think a friend or family member can do anything. While it's easy to say it's your option out now, think about what you're putting them through and that they'll be the ones doing the deed since you may not be in a condition to do it yourself (i.e., you can't feed yourself).

In any case, the ongoing experience has pushed us to investigate the CCRC option, even though it's hopefully decades away for us. We don't want to put our kids through this

Last edited: