Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

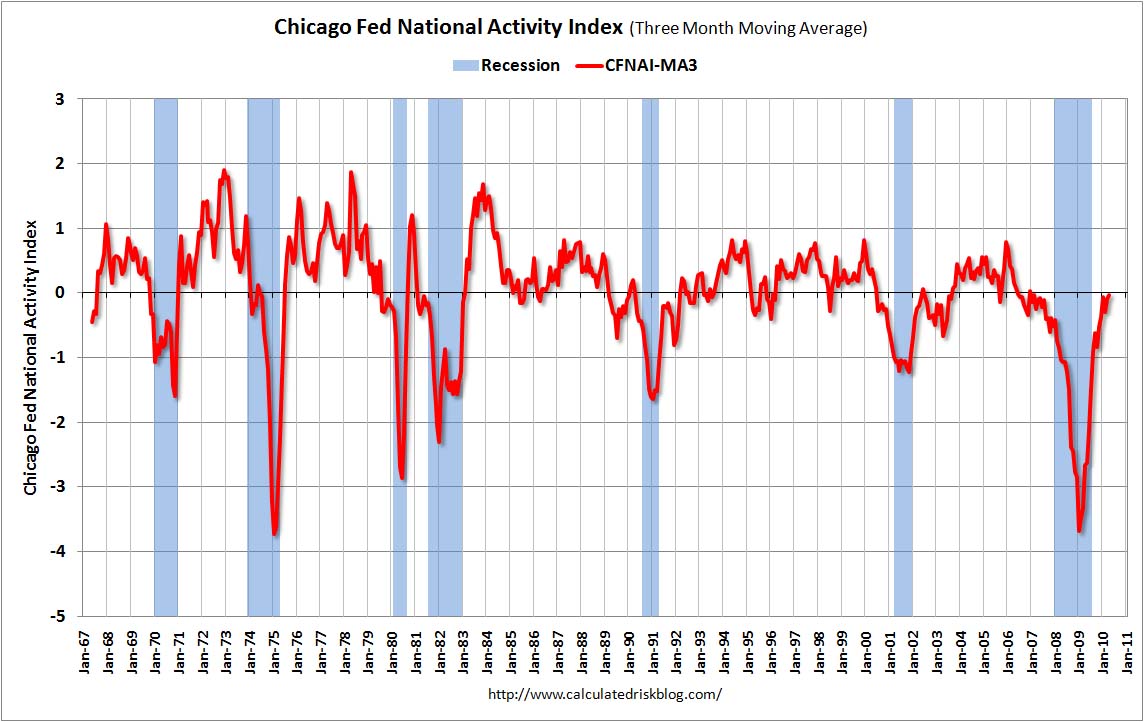

I agree it IS far better than it was. I just don't think it's anything to cheer about. In another post I wrote we apparently need 100,000 jobs just to stay even. During the bubbles we were making 200,000 jobs or so. If we have a robust recovery bordering on a bubble we net positive 100,00

I am certainly cheering that we are not loosing 700,000 jobs a month anymore.

Exactly what Zathras said.

Originally when stocks turned up the pessimists said "look around, things are horrible. Stock PE's are through the roof and we don't know where "E" is going." When earnings came in better than expected the pessimists said "It's all cost cutting, you can't cut your way to prosperity". Then revenues started to grow. And we heard the pessimists say "But where are the jobs. We can't have a recovery without jobs". Now we have some job growth and the pessimists say "But we're not adding enough jobs"

Not everything is perfect. But once everything is perfect, about 75% of the expansion will be over.

During the bubbles we were making 200,000 jobs or so. If we have a robust recovery bordering on a bubble we net positive 100,000 jobs a month. 84 months needed to get back were we were before we lost 8.4 million jobs.

I don't agree with this at all. There is a huge difference between trying to add jobs when the economy is already at full employment and when there is tremendous slack in the labor force.