You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is the double dip coming?

- Thread starter Florida

- Start date

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

IndependentlyPoor

Thinks s/he gets paid by the post

I am more than a little worried about this

but I am not about to bet my portfolio on any prediction. Sticking with my conservative equity/fixed allocations.

but I am not about to bet my portfolio on any prediction. Sticking with my conservative equity/fixed allocations.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

ECRI says no double dip this year. These guys are the best in business cycle prediction. ECRI - Double Dip Fears 'Remain Unfounded'

Also this past Friday

Near term inflation is not out of control either. Sure, a lot of money has been printed, but that by itself is not inflationary. Not in the current environment where it is counterbalancing extreme de-leveraging (paying down debt) by the private sector. When the private sector stops deleveraging, foreclosures etc., and unemployment rates drop strongly, then there may be an issue if the Fed does not back off the stimulus.

Audrey

Also this past Friday

"With the WLI close to an all-time high, a double dip remains out of the question," said Lakshman Achuthan, managing director of ECRI. WLI Level At Nine-Week High

Near term inflation is not out of control either. Sure, a lot of money has been printed, but that by itself is not inflationary. Not in the current environment where it is counterbalancing extreme de-leveraging (paying down debt) by the private sector. When the private sector stops deleveraging, foreclosures etc., and unemployment rates drop strongly, then there may be an issue if the Fed does not back off the stimulus.

Audrey

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

I am more than a little worried about this

And yet . . .

On a seasonally adjusted basis, the CPI-U was unchanged in February

And . . .

Federal Reserve Chairman Ben S. Bernanke signaled that sales of the central bank’s holdings in mortgage-backed securities may play a more prominent role in the withdrawal of monetary stimulus than he indicated last month.

IndependentlyPoor

Thinks s/he gets paid by the post

It is the sale of the mortgage backed securities that has me worried. Normally the Fed pulls money out of circulation by selling Treasuries. This time (and for the first time) they are going to try to sell a mountain of [-]crap[/-] mortgage backed securities for which there might be no market, or only a market at drastically reduced prices. At best this would pull less money out of circulation than planned. As for the worst case... I haven't the foggiest idea of what would happen if the Fed were forced to take a gigantic loss.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

It is the sale of the mortgage backed securities that has me worried. Normally the Fed pulls money out of circulation by selling Treasuries. This time (and for the first time) they are going to try to sell a mountain of [-]crap[/-] mortgage backed securities for which there might be no market, or only a market at drastically reduced prices. At best this would pull less money out of circulation than planned. As for the worst case... I haven't the foggiest idea of what would happen if the Fed were forced to take a gigantic loss.

The mortgage the Fed owns aren't "crap" . . . they're all essentially backed by the U.S. government.

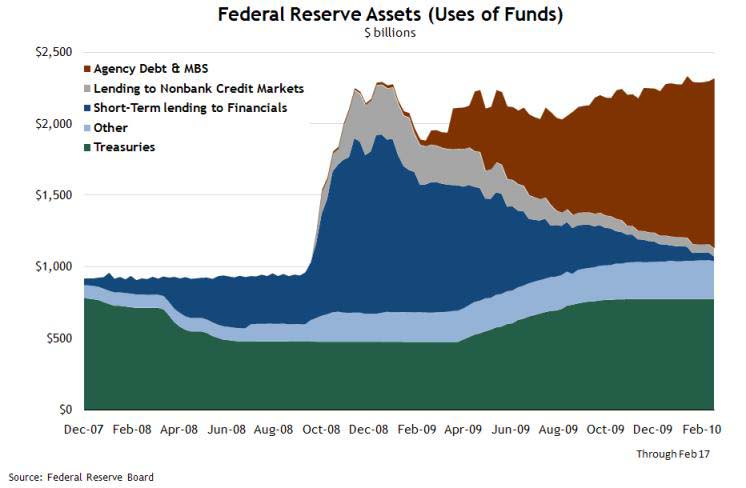

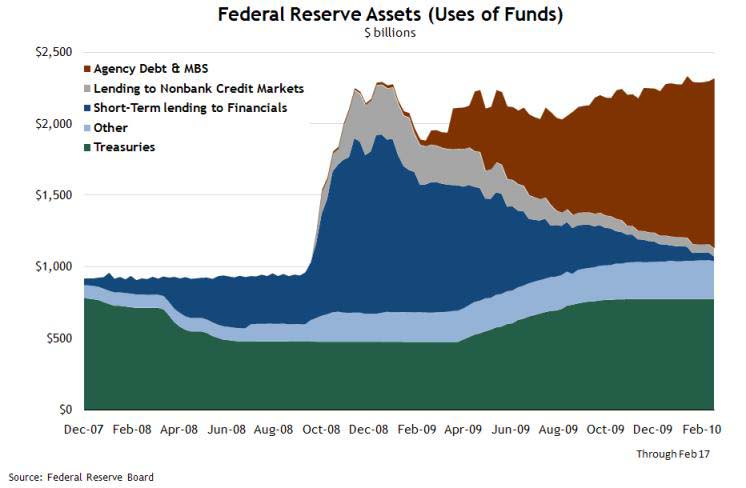

The Fed has a variety of ways it can shrink its balance sheet and withdraw liquidity, so I wouldn't expect them to try to flood the market with bonds. Bernanke has been pretty clear about all of the tools he expects to use to normalize monetary policy. Everything from paying interest on reserves, to engaging in reverse repos, to allowing the portfolio to simply roll off (your chart shows how quickly the Fed's original asset purchases rolled down), to selling securities.

Pete

Recycles dryer sheets

- Joined

- May 9, 2008

- Messages

- 350

Our So Cal economy is in pretty bad shape....Deflation or disinflation for the most part. However, the prices of homes in good areas are staying extremely high. 3 houses in my neighborhood just sold for prices equal to the all time highs. All of them were purchased by foreigners.

I think there is plenty of inflation out there...dollars in the hands of foreigners and the rich....when they decide to spend them....look out.

I think there is plenty of inflation out there...dollars in the hands of foreigners and the rich....when they decide to spend them....look out.

IndependentlyPoor

Thinks s/he gets paid by the post

The mortgage the Fed owns aren't "crap" . . . they're all essentially backed by the U.S. government.

The Fed has a variety of ways it can shrink its balance sheet and withdraw liquidity, so I wouldn't expect them to try to flood the market with bonds. Bernanke has been pretty clear about all of the tools he expects to use to normalize monetary policy. Everything from paying interest on reserves, to engaging in reverse repos, to allowing the portfolio to simply roll off (your chart shows how quickly the Fed's original asset purchases rolled down), to selling securities.

Okay, I admit to being overly snarky with the cr@p mortgages bit.

And I sincerely hope you are correct and that the Fed manages its return to normalcy with aplomb.

W2R

Moderator Emeritus

I don't know if we are going to get a double dip with respect to the market. I doubt anybody can accurately predict what is going to happen with the market, except that it will go up, then down, then up, then down, repeat ad infinitum. So yes, I believe it will go down again but the timing is pretty iffy.

However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

IndependentlyPoor

Thinks s/he gets paid by the post

Mmmm!However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

Can I have sprinkles?

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just to be clear, in my post above I was referring to a double-dip in the economy (i.e. another recession). Nothing to do with the markets - they dip and they soar on mood alone....I don't know if we are going to get a double dip with respect to the market. I doubt anybody can accurately predict what is going to happen with the market, except that it will go up, then down, then up, then down, repeat ad infinitum. So yes, I believe it will go down again but the timing is pretty iffy.

However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

The phrase "double-dip" normally refers to the economy and whether it will return to recession soon.

Audrey

W2R

Moderator Emeritus

The phrase "double-dip" normally refers to the economy and whether it will return to recession soon.

Oh, I had heard it used to predict another impending market crash, similar to the crash of 2008-2009. Oh well! Thanks for the correction. I am sure that the "non-dip" of the 2008-2009 market will happen again, to a greater or lesser extent, as the market rises and falls. Since we have been on an upswing for the past year, it is only logical to think that the next overall trend will be downwards. Then up, then down, repeated ad infinitum. The timing is something that I do not know, though, and I doubt anyone else does either.

IndependentlyPoor said:Mmmm!

Can I have sprinkles?

Hmm! Looks pretty nice - - now, by double dip did you mean two scoops of ice cream, or a doubly dipped cone? I was thinking of a scoop of vanilla with a scoop of chocolate on top, dipped and covered with sprinkles...

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Oh, I had heard it used to predict another impending market crash, similar to the crash of 2008-2009.

It is used a bit interchangeably, because its a cause and effect kind of thing. The market tanks because the economy "double dips". But the "double dip" is referencing recession, not market moves.

W2R

Moderator Emeritus

It is used a bit interchangeably, because its a cause and effect kind of thing. The market tanks because the economy "double dips".

That was my understanding of it. But apparently any mention of a "double dip with respect to the market" (as in my post below) is incorrect.

Gone4Good said:But the "double dip" is referencing recession, not market moves.

It wasn't referencing recession in my post (see below). Guess it is so heavily used as a term that usage of it in the plain English sense, as in looking at market trends as a function of time, is misleading even when I have spelled out what I am referring to. Sorry 'bout that. Live and learn!

I can tell that it is time for me to stop reading this thread and go take a nap.

I don't know if we are going to get a double dip with respect to the market. I doubt anybody can accurately predict what is going to happen with the market, except that it will go up, then down, then up, then down, repeat ad infinitum. So yes, I believe it will go down again but the timing is pretty iffy.

So, the market being one of several symptoms indicative of a recession,

However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

However, if you were referring to a double dip ice cream cone, I think that is an excellent thought, which I intend to ponder.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, there was a pair of drastic sell-offs - one in Nov 2008, and one in March 2009. These, though, are usually referred to as "bottoms" LOL! And they often do come in pairs!Oh, I had heard it used to predict another impending market crash, similar to the crash of 2008-2009. Oh well! Thanks for the correction.

Theoretically, though, if the economy were to go back into recession, that should be preceded by another bear market (not necessarily a crash, however). At least that is what people expect.

But the stock market is a notoriously unreliable predictor of recessions. You'd think the horrible selloff in late March of 2009 was predicting bad economic times ahead, yet just a few months thereafter, we started coming out of recession. The worst of the economic bad times had already occurred (and were just becoming obvious).

We entered the last recession in December of 2007, yet the stock market didn't enter bear market territory until 7 months later!!!!! Sure, we had had a market top in Oct of 2007, but it didn't sell off that much and Dec 2007 ended on a pretty good note - barely off from peak. No warning there at all!

Audrey

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

These, though, are usually referred to as "bottoms"

I recall a great deal of hand-wringing in March of last year as to whether the lows would hold. By that time we were quite tired of having our bottom repeatedly violated.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Oh sure! It's impossible to see what is going on when you are in the middle of it.I recall a great deal of hand-wringing in March of last year as to whether the lows would hold. By that time we were quite tired of having our bottom repeatedly violated.

And in this case the March bottom was so much lower than the November bottom that a lot of folks didn't trust we'd actually seen the usual "pair".

And it is only because we've already gone a year past the March bottom that a near term retest seems unlikely, and that was likely "it" - at least for a while.

Of course the 2008/2009 bottoms violated the 2002/2003 lows, so you never know how bad it might get in the future!

Audrey

IndependentlyPoor

Thinks s/he gets paid by the post

EEEEK! Technical indicators! Run! Hide!Of course the 2008/2009 bottoms violated the 2002/2003 lows, so you never know how bad it might get in the future!

Orchidflower

Thinks s/he gets paid by the post

- Joined

- Mar 10, 2007

- Messages

- 3,323

Squawk Box in the morning's experts say no double dip in 2010. May have that slide down in 2011, tho. More fun times ahead, kids!

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Oh - don't listen to anyone on CNBC's Squawk Box - it's the worst for sensible predictions! The same goes for any kind of investing advice.Squawk Box in the morning's experts say no double dip in 2010. May have that slide down in 2011, tho. More fun times ahead, kids!

Audrey

We are not going to have a double dip recession. Roubini was wrong, plain and simple. He had his 15 minutes of fame.

In fact, I read the other day that we have never had a double dip recession. Many think the two back to back recessions of the early 80's were a double dip but the article I read said there were several quarters of growth in between so it wasn't really a double dip, just two recessions in close proximity. I guess a true double dip remains a concept to keep people on the sidelines while we make money in equities.

In fact, I read the other day that we have never had a double dip recession. Many think the two back to back recessions of the early 80's were a double dip but the article I read said there were several quarters of growth in between so it wasn't really a double dip, just two recessions in close proximity. I guess a true double dip remains a concept to keep people on the sidelines while we make money in equities.

Steve O

Recycles dryer sheets

- Joined

- Dec 16, 2007

- Messages

- 291

The bear market for bonds may be underway...

TIPS sure have been taking a beating lately...

Maybe time to start slowly averaging in...

TIPS sure have been taking a beating lately...

Maybe time to start slowly averaging in...

Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Congress is not done destroying the middle class. Be patient.

rescueme

Thinks s/he gets paid by the post

I agree with you; he's been saying the "chicken little" phrase for two long. Of course, that's only my opinion - which dosen't count for muchWe are not going to have a double dip recession. Roubini was wrong, plain and simple. He had his 15 minutes of fame.

I did see an interesting article on M* this morning, concerning the lack of confidence in the current "recovery" (if you believe there is one).

For your reading enjoyment:

The Recovery That No One Wants to Believe In

Similar threads

- Replies

- 2

- Views

- 606

- Replies

- 33

- Views

- 2K

- Replies

- 28

- Views

- 2K