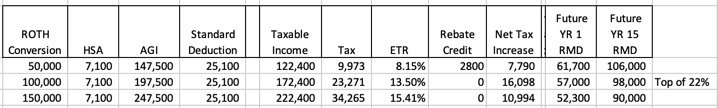

I think I made a final decision but wanted to get insight from the group to see if the concensus was the same as what I'm thinking. Below is a screenshot of a simplified spreadsheet section (missing other income columns) showing the 2021 tax calculations at three different levels of conversations ($50K, $100K and $150K).

The question becomes:

1. do a small conversation ($50K) to get a very low 2021 tax liability plus the $2,800 stimulus refund.

2. do a larger conversation ($100K or $150K) resulting in a higher 2021 tax liability, no stimulus refund, but lower future RMDs.

The last two columns show the estimated RMDs based on projected future balances of my IRA. These RMDs assume that after 2021 I aggressively convert up to the IRMMA limits until RMD age. If I don't do many conversations between now and age 72 my RMDs would be closer to $200K in Year 1 and $315K in Year 15.

I've got sufficient funds outside of the IRA to pay the taxes on the conversations.

The question becomes:

1. do a small conversation ($50K) to get a very low 2021 tax liability plus the $2,800 stimulus refund.

2. do a larger conversation ($100K or $150K) resulting in a higher 2021 tax liability, no stimulus refund, but lower future RMDs.

The last two columns show the estimated RMDs based on projected future balances of my IRA. These RMDs assume that after 2021 I aggressively convert up to the IRMMA limits until RMD age. If I don't do many conversations between now and age 72 my RMDs would be closer to $200K in Year 1 and $315K in Year 15.

I've got sufficient funds outside of the IRA to pay the taxes on the conversations.