Hello, For awhile now I’ve been a fan of these forums, trying to learn as much as I can.

Always had a dream of early retirement in some way shape or form. I kind of now look at retirement as being able to work and have days off on my terms. After reading so many other introductions I’m probably one of the smaller fish here, but I feel that if I play my cards right I can end up in pretty good shape.

So here my details, I’m 44 years old

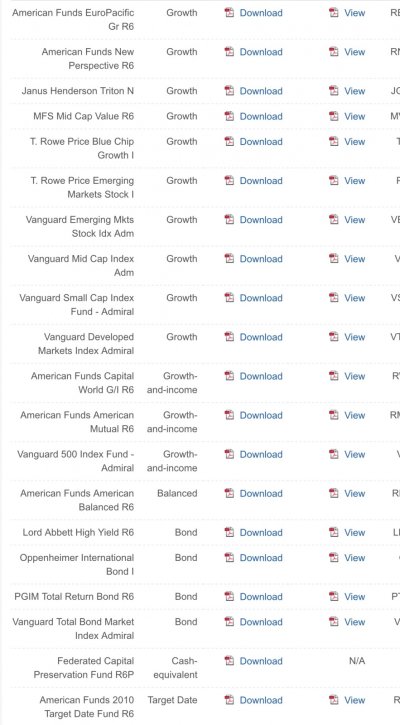

My main chunk of retirement is in a 401k from my previous job..$380k in a American funds Target fund.

I’ve got a personal Roth IRA through Betterment that is around 28k...75/25 stock/Bond Mix.

My Current jobs 403B is around 10k in a Vangaurd index fund (Transamerica)

My main question is what to do with my previous 401k. I do have the option to stay in the plan as the funds are R6 as expenses are Low. Or should I roll it and my Betterment over to somewhere else?

Some other details I’m married with no kids. My spouse has about 150k in current 403b. We both out about 15% a year into our current plan.

I also continue to fund my personal Betterment IRA.

I do like the simple 3 index fund logic that I’ve found a few places on this forum, I’m just not sure if it’s something I can manage on my own or have to pay an advisor to do for me?

Please feel free to offer you advice, as I’ve wanted to do this for sometime.....constructive criticisms welcomed [emoji1360].

I’ve tried the Firecal i don’t have enough saved to make it work for me, but I’m still hopeful to have a rather good retirement. Right now my goal is to retire at 60.... Maybe sooner if I can. Please let me know if I’ve left anything out. Again any advice to help me along to try to achieve my goal would be great.... thanks in advance and please everyone keep posting... it truly is helpful.

Always had a dream of early retirement in some way shape or form. I kind of now look at retirement as being able to work and have days off on my terms. After reading so many other introductions I’m probably one of the smaller fish here, but I feel that if I play my cards right I can end up in pretty good shape.

So here my details, I’m 44 years old

My main chunk of retirement is in a 401k from my previous job..$380k in a American funds Target fund.

I’ve got a personal Roth IRA through Betterment that is around 28k...75/25 stock/Bond Mix.

My Current jobs 403B is around 10k in a Vangaurd index fund (Transamerica)

My main question is what to do with my previous 401k. I do have the option to stay in the plan as the funds are R6 as expenses are Low. Or should I roll it and my Betterment over to somewhere else?

Some other details I’m married with no kids. My spouse has about 150k in current 403b. We both out about 15% a year into our current plan.

I also continue to fund my personal Betterment IRA.

I do like the simple 3 index fund logic that I’ve found a few places on this forum, I’m just not sure if it’s something I can manage on my own or have to pay an advisor to do for me?

Please feel free to offer you advice, as I’ve wanted to do this for sometime.....constructive criticisms welcomed [emoji1360].

I’ve tried the Firecal i don’t have enough saved to make it work for me, but I’m still hopeful to have a rather good retirement. Right now my goal is to retire at 60.... Maybe sooner if I can. Please let me know if I’ve left anything out. Again any advice to help me along to try to achieve my goal would be great.... thanks in advance and please everyone keep posting... it truly is helpful.