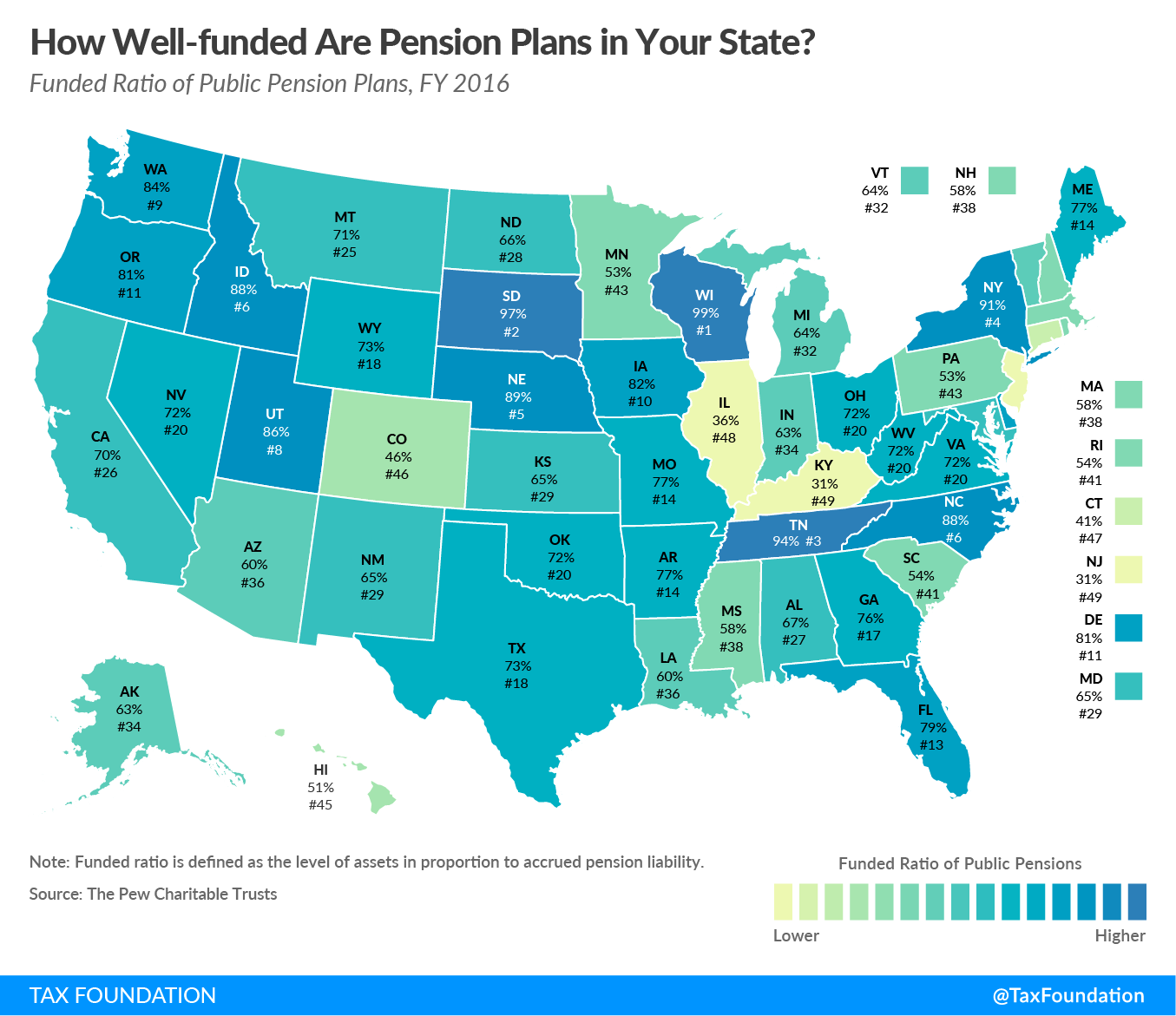

Hopefully a look at pensions, starting with public pensions, which may not seem important for those with careers in the private sector, but affects all of us in terms of public debt. Putting the current government shutdown aside for the moment, the longer view of National and Local pensions is worrisome.

Let's start by looking ar just one pension plan. The Chicago Teacher Pension Plan. Currently measured at more than 11 Billion Dollars, the plan is incurring an annual interest rate charge of @230million dollars, just to cover current obligations.

That is for just one city.

........................................................................................................

The genesis for this comes indirectly from long term plans for a sustaining insurance policy for public service, and was created at a time when interest rates were in the double digits. Unfortunately, as time changed the investment returns, the local government did not address the construct of the pension plan, and projections were made at a too optimistic rate.

Oversimple, but essentially the basis for today's nightmare.

.......................................................................................................

If this were an anomaly, we could overlook it, and tend to our own business.

The trouble is, the problem exists in hundreds, possibly thousands of public entities. Cities, towns, counties and state tax enabled constructs.

.......................................................................................................

Private pensions are not exempt, but should be discussed on a separate thread. More food for thought and discussion, but not here. Public pensions affect all of us... in taxes, and in public services.

More food for thought and discussion, but not here. Public pensions affect all of us... in taxes, and in public services.

Our county is generally considered safe, and well managed. That is, until we look at long term pension obligations. Young police officers are looking at pensions in the $60K+ range. The numbers just don't work out.

A subject that is commonly overlooked in meetings and public elections, but a major factor in the future of our nation and our personal taxes.

Do you know how pensions obligations affect your future?

Let's start by looking ar just one pension plan. The Chicago Teacher Pension Plan. Currently measured at more than 11 Billion Dollars, the plan is incurring an annual interest rate charge of @230million dollars, just to cover current obligations.

That is for just one city.

........................................................................................................

The genesis for this comes indirectly from long term plans for a sustaining insurance policy for public service, and was created at a time when interest rates were in the double digits. Unfortunately, as time changed the investment returns, the local government did not address the construct of the pension plan, and projections were made at a too optimistic rate.

Oversimple, but essentially the basis for today's nightmare.

.......................................................................................................

If this were an anomaly, we could overlook it, and tend to our own business.

The trouble is, the problem exists in hundreds, possibly thousands of public entities. Cities, towns, counties and state tax enabled constructs.

.......................................................................................................

Private pensions are not exempt, but should be discussed on a separate thread.

Our county is generally considered safe, and well managed. That is, until we look at long term pension obligations. Young police officers are looking at pensions in the $60K+ range. The numbers just don't work out.

A subject that is commonly overlooked in meetings and public elections, but a major factor in the future of our nation and our personal taxes.

Do you know how pensions obligations affect your future?