You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Adding Int'l Index Fund - - - Why?

- Thread starter Red Badger

- Start date

Senator

Thinks s/he gets paid by the post

Go over to bogleheads.org and do a search on this subject. It is raised and debated often.

33% of our equities are ex-US.

Neither Buffet or Bogle are warm on International equities.

Investment legends Jack Bogle and Warren Buffet have a few things in common: They embrace low fees and index investing, and millions of people look to them for investing wisdom. One other thing: When it comes to investing, both are homebodies.

Bogle dismisses international diversification. Buffett, meanwhile, says an index fund portfolio of 90 percent S&P 500 and 10 percent Treasurys is probably good enough for most investors — that's how he is recommending his wife invest. But the anti-international stance is the rare piece of investment advice over which many people dare to disagree with Bogle and Buffett.

https://www.cnbc.com/2017/04/17/a-s...-shared-by-jack-bogle-and-warren-buffett.html

Buffet? Berkshire Hathaway has investments in foreign stocks, and also direct ownership of foreign companies. Do you have a link to any comment Warren Buffet has made that discourages investment in int'l equities?Neither Buffet or Bogle are warm on International equities.

Which Roger

Thinks s/he gets paid by the post

- Joined

- Jun 5, 2013

- Messages

- 1,019

My biggest issue with adding international stocks is I wouldn't know what area of the World to invest in. I do not know enough about overseas markets to risk any significant money there. This doesn't mean it's a bad idea if one does so. It could turn out to be wonderful.

Just buy an index fund that encompasses the rest of the world, then you don't have to know anything.

I have 1/3 of my stock in international. It's always felt right for me. But the decision of how much to allocate to stocks vs bonds is much more important than how to divvy up the stocks.

capjak

Full time employment: Posting here.

Source?

There are several on google that are on both sides of the passive vs active for undeveloped xUS and Emerging Markets. Need to investigate for your self but the political etc... unknowns are sometimes better with active or better yet avoid those countries.

Not recommending this fund but first one I found via google... “To win in emerging markets,avoid the passive investing rush” Bloomberg

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

@Senator, it seems that you frequently make jingoistic comments like this. I don't know if you're just trolling for fun or if you are serious.I think many foreign countries operate on corruption and bribes. Legal or not. ..

Re corruption, the US is ranked eighteenth from the best, beat by most of the EU, by Hong Kong, Australia, and Singapore among others. My guess is that on a cap-weighted basis the US is about average for the pack. Certainly you should not be feeling particularly holy about the US. https://www.transparency.org/news/feature/corruption_perceptions_index_2016

Maybe you don't travel?

@UnrealizedPotential you're missing a very important point here: Nobody else knows either.My biggest issue with adding international stocks is I wouldn't know what area of the World to invest in. ...

Trying to pick countries, regions, or sectors is likely to be a losing proposition and is really not that far from stock picking, which is a statistically proven loser. The funds many of us have mentioned in this threads are passive funds that simply buy everything. To the degree that we can know anything, we know that the long term trend of stocks is upwards. We don't know how fast, we do know that there will be reversals along the way, but we also know that buying the market means that there are literally hundreds of millions of people working hard to make money for us, the stockholders. So we simply ride the wave.

A Bogleism that I think has already been mentioned: "Don't do something, just sit there!" A Buffetism is similar: "The market is a mechanism for transferring money from the impatient to the patient."

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The correlation between US stocks and Int stocks is about 0.77 so it doesn't add much diversity, but it does add considerable volatility. If you want some more diversity add 2-5% GLD to a 60:40 stock bond portfolio. Bonds are .07 correlated and gld is -.04

The data suggests otherwise.... the volatility of a 100% US stocks portfolio and a 70/30 US stocks/international stocks portfolio are quite similar. For example, for 1997 to 2017 YTD, the standard deviations were 15.42% for a 100% US stock portfolio (VITSX) and 15.54% for a 70/30 US/international portfolio (VITSX/VGTSX).... rebalanced annually.

See https://www.portfoliovisualizer.com/backtest-portfolio#analysisResults

to test different periods of time or different allocations.

Senator

Thinks s/he gets paid by the post

Buffet? Berkshire Hathaway has investments in foreign stocks, and also direct ownership of foreign companies. Do you have a link to any comment Warren Buffet has made that discourages investment in int'l equities?

I included a link in the post above. Berkshire invests in many things, including international companies. Buffet does not even recommend individuals buy Berkshire Hathaway.

https://www.cnbc.com/2017/04/17/a-s...-shared-by-jack-bogle-and-warren-buffett.html

I have never seen Warren give an individual investor advice to buy international equities.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I included a link in the post above. Berkshire invests in many things, including international companies. Buffet does not even recommend individuals buy Berkshire Hathaway.

https://www.cnbc.com/2017/04/17/a-s...-shared-by-jack-bogle-and-warren-buffett.html

I have never seen Warren give an individual investor advice to buy international equities.

I wonder if it might be a do as I say vs say what I do thing since Berkshire does have a lot of international investments and operations.

While I prefer a significant allocation to international stocks, from the data that I have seen it doesn't seem to make a drastic diffference either way.

Senator

Thinks s/he gets paid by the post

@Senator, it seems that you frequently make jingoistic comments like this. I don't know if you're just trolling for fun or if you are serious.

Re corruption, the US is ranked eighteenth from the best, beat by most of the EU, by Hong Kong, Australia, and Singapore among others. My guess is that on a cap-weighted basis the US is about average for the pack. Certainly you should not be feeling particularly holy about the US. https://www.transparency.org/news/fe...ons_index_2016

Maybe you don't travel?

I know many people, from many international countries and many have stories about bribery. Especially Mexico.

My own mother had a green card from Mexico, so she could live there, and she had someone else use their thumbprints so she would not have to go to the office to do it herself.

Many friends from India, Iran, Pakistan, China etc. have similar stories. Probably European countries, and Japan, are better than others.

The USA is no saint, but it is the most trusted country when it come to finances. Hence it is the world's reserve currency. It also leads in returns when compared to other international investing options.

Senator

Thinks s/he gets paid by the post

I wonder if it might be a do as I say vs say what I do thing since Berkshire does have a lot of international investments and operations.

While I prefer a significant allocation to international stocks, from the data that I have seen it doesn't seem to make a drastic difference either way.

Exactly. And it is far easier to manage a S&P ETF than reallocate and pay taxes every year strictly due to re-balancing.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

..... And it is far easier to manage a S&P ETF than reallocate and pay taxes every year strictly due to re-balancing.

Not really... I don't see having both domesitc and international equities making rebalancing any more difficult than if I had just domestic equities.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The plural of "anecdote" is not "data." I gave you a link to the data.I know many people, from many international countries and many have stories about bribery. Especially Mexico.

My own mother had a green card from Mexico, so she could live there, and she had someone else use their thumbprints so she would not have to go to the office to do it herself.

Many friends from India, Iran, Pakistan, China etc. have similar stories. Probably European countries, and Japan, are better than others.

You're entitled to your own opinions of course but you are not entitled to your own facts. Can you back that statement up? Clearly the corruption index implies that your statement is false.The USA is no saint, but it is the most trusted country when it come to finances. ...

The reasons that the dollar is currently the world's reserve currency are complex and somewhat rooted in history, but "trust" is only one of them and probably not the primary one. We are basically the tallest midget; the dollar has issues but the alternatives are, at this time, worse. That will change and much of the world is rooting for sooner rather than later.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

...We are basically the tallest midget; the dollar has issues but the alternatives are, at this time, worse. ...

A more app description might be that we are the best looking horse in the glue factory.

RISP

Recycles dryer sheets

- Joined

- Jul 18, 2012

- Messages

- 407

I think some posters in this thread are mixing up 'international' with 'emerging markets'. There is a difference between Switzerland and Zimbabwe, though.

Regarding the OP's question, why would anyone put 100% of their equity allocation in just one country? Even if it's the world's most important economy? I wouldn't be comfortable with the political risks. Yes, it went exceptionally well for the last few hundred years, but past performance is not indicative of future results, as we all know.

Even if it's the world's most important economy? I wouldn't be comfortable with the political risks. Yes, it went exceptionally well for the last few hundred years, but past performance is not indicative of future results, as we all know.

The MSCI World has 59% US holdings (link, p. 2). So anything <41% international is basically a sector bet, and that does not even take emerging markets into account.

For my own portfolio, I use a combination of ETFs tracking

a) the developed world (MSCI World)

b) emerging markets (MSCI EM)

c) my home currency region (Eurostoxx600)

c) is probably unnecessary, as MSCI World and Eurostoxx600 are heavily correlated. But I prefer to be overweighted in equities denominated in €.

@OldShooter: 'The plural of "anecdote" is not "data"' absolutely made my day.

Regarding the OP's question, why would anyone put 100% of their equity allocation in just one country?

The MSCI World has 59% US holdings (link, p. 2). So anything <41% international is basically a sector bet, and that does not even take emerging markets into account.

For my own portfolio, I use a combination of ETFs tracking

a) the developed world (MSCI World)

b) emerging markets (MSCI EM)

c) my home currency region (Eurostoxx600)

c) is probably unnecessary, as MSCI World and Eurostoxx600 are heavily correlated. But I prefer to be overweighted in equities denominated in €.

@OldShooter: 'The plural of "anecdote" is not "data"' absolutely made my day.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes. I have seen numbers for the US as % of total world in the 45-55% range so I tend to think 50/50. Agree completely on your point that any portfolio that doesn't own everything is in fact betting on sectors.... The MSCI World has 59% US holdings (link, p. 2). So anything <41% international is basically a sector bet, and that does not even take emerging markets into account. ...

I think that one of the reasons that home country bias is not crystal clear is the argument that investing "outside" involves currency risk. It is often stated as: "My expenses are in dollars (or Euros) so that's where I should have my investments." No one knows the future of course, but I think there are reasons to expect a long-term decline in the dollar, which would argue for underweighting my home country. So a portfolio tilt designed to take advantage of currency movements might be a viable choice for some.... c) my home currency region (Eurostoxx600)

c) is probably unnecessary, as MSCI World and Eurostoxx600 are heavily correlated. But I prefer to be overweighted in equities denominated in €.

Thanks. it's a critically important point that's often forgotten in the heat of posting and, actually, not understood by some. I wish I could claim originality but I stole it from SGOTI.... @OldShooter: 'The plural of "anecdote" is not "data"' absolutely made my day.

gayl

Thinks s/he gets paid by the post

which is why I put 15% in SCHF and let it rideMy biggest issue with adding international stocks is I wouldn't know what area of the World to invest in

https://seekingalpha.com/symbol/SCHF/key-data/dividends-and-splits

8% 5 yr growth rate / 0.06% expense ratio

Last edited:

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I see no issue with not including international equities.

I have had virtually no direct international equity exposure since 2012, but own a large portion of SPY and equivalents.

5 yr return for S&P 500 - 83%

5 yr return for EFA - 26.4%

(a broad int'l ETF)

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can't seem to duplicate those numbers. What date range did you use? Also, the EFA number seems to be simply daily stock price, not total return. Not sure about the S&P number being total return, though it looks like it might be, without knowing the dates.I have had virtually no direct international equity exposure since 2012, but own a large portion of SPY and equivalents.

5 yr return for S&P 500 - 83%

5 yr return for EFA - 26.4%

(a broad int'l ETF)

Senator

Thinks s/he gets paid by the post

I can't seem to duplicate those numbers. What date range did you use? Also, the EFA number seems to be simply daily stock price, not total return. Not sure about the S&P number being total return, though it looks like it might be, without knowing the dates.

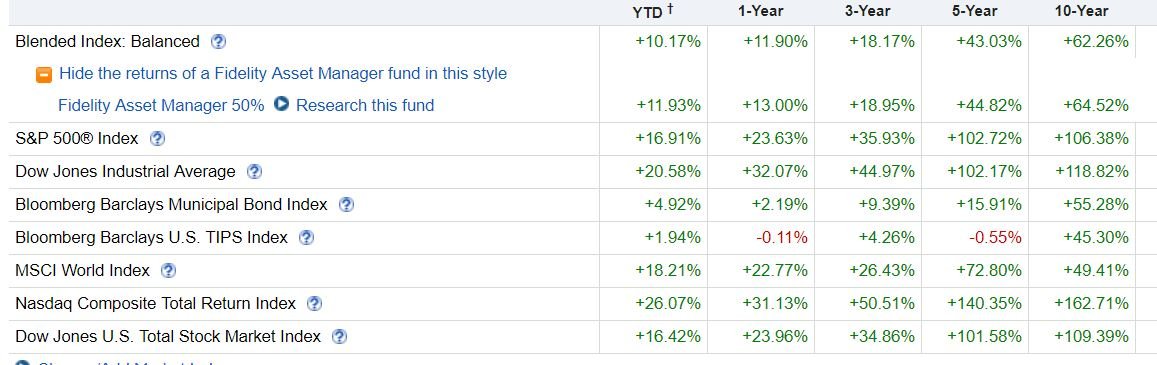

Here is what Fido says about the indexes as of 10/31/2017.

Attachments

gayl

Thinks s/he gets paid by the post

Who's FIDO?

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

FIDO = Fidelity

DEC-1982

Full time employment: Posting here.

If you have just two funds today (US Stock and US Bond), and you add an Intnl Stock Fund, you increased the number of funds you hold by 50%. If you decided to add an Intnl Stock Fund and an Intnl Bond Fund, you increased the number of funds you hold by 100%. Complexity may not matter yet, but it will bite at some point.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yeah. Thanks. Those are the total return type of numbers I was getting. One of the problems I have when researching this type of thing is making sure I am getting total return. S&P is easy: https://finance.yahoo.com/quote/^SP500TR/ but some of the others not so much. That's probably why @DrRoy's numbers were apples & oranges.Here is what Fido says about the indexes as of 10/31/2017.

No doubt that the US market has outperformed in the last few years; every dog has his day. But if anything that might indicated that it's the international sector's turn over the next few years as the US regresses to the mean. That's why I don't make sector bets.

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can't seem to duplicate those numbers. What date range did you use? Also, the EFA number seems to be simply daily stock price, not total return. Not sure about the S&P number being total return, though it looks like it might be, without knowing the dates.

I put up a FIDO comparison chart and asked for the last 5 years as the time period.

Similar threads

- Replies

- 40

- Views

- 3K

- Replies

- 51

- Views

- 5K