You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Any Retirement Calculators That Include Taxes?

- Thread starter MercyMe

- Start date

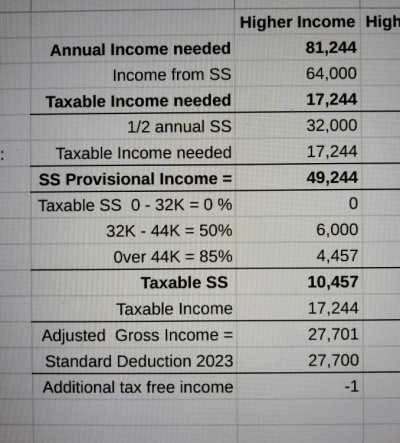

So I played around with this little spreadsheet I made. I think it's correct. If your SS was 64K and taxable income was 18,466 total 81,466 would be tax free with 2023 standard deduction.

View attachment 46785

This is a tax calculator that someone shared on this forum in the past. It's really good.

https://www.irscalculators.com/tax-calculator

So I played around with this little spreadsheet I made. I think it's correct. If your SS was 64K and taxable income was 18,466 total 81,466 would be tax free with 2023 standard deduction.

View attachment 46785

Based on this tax calculator, it looks correct.

https://www.irscalculators.com/tax-calculator

Out-to-Lunch

Thinks s/he gets paid by the post

Here is a very good source for determining true marginal tax rates (including SS). You can download an Excel spreadsheet at the link below:

Calculator for Marginal Tax Rates

Calculator for Marginal Tax Rates

Maxifi figures taxes (federal and state) in the reports you can see net taxes and your taxable income and marginal bracket , effective rate, AMT, credits and refundable credits for a given profile (Plan) . You can look at any given year or see the grand total on the lifetime balance sheet.

It is an economic planner that is taking us into retirement. It costs about $100/ year.

You also enter property taxes that are used to project your fixed expenses.

It is an economic planner that is taking us into retirement. It costs about $100/ year.

You also enter property taxes that are used to project your fixed expenses.

Last edited:

- Joined

- Apr 14, 2006

- Messages

- 23,103

I agree about doing your taxes in January. That's what I do, so I can have a clear financial picture of the year ahead. I account for pension and SS income, expected taxable interest and distributions and tIRA distributions or conversions. If I need to adjust withholding from our pensions, I do it then.

Can someone post the link for the Fidelity Retirement Planner? I'm finding multiple different Fidelity Retirement related things and can't figure out which one is being discussed on this thread. I found a Fidelity Financial Independence Planner. Is that it?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Can someone post the link for the Fidelity Retirement Planner? I'm finding multiple different Fidelity Retirement related things and can't figure out which one is being discussed on this thread. I found a Fidelity Financial Independence Planner. Is that it?

I can’t post a link to it without being signed in, but try this.

Main web page go under Planning and Advice, then Retirement, then bottom left Get Started. You likely have to sign in or create an account to use it. If you are not a Fidelity customer, you’ll have to enter all your accounts manually. The detailed expense budget is the key. Spend some time on for it to be useful. The first time may take an hour or two.

This is a tax calculator that someone shared on this forum in the past. It's really good.

https://www.irscalculators.com/tax-calculator

Agree. I showed this calculator to our accountant. He said this is a good way to estimate your taxes. There might be a couple of adjustments, but it gives a good idea. We play with the numbers for Roth conversions, SS, selling LT stock funds, etc. It's pretty self-explanatory.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1. I wrote a 'withholding workbook' about 4 years ago, I update monthly to calculate Fed and state estimated taxes.My advice to you is to learn how to do your personal taxes, then start doing your taxes in January! Don’t start last year’s taxes, start your current year’s taxes so you know at what dollar amount your will cross over from the 22.2% marginal tax rate into the 40.7% or 49.95% marginal tax rate!

It also allows me to manage tax bracket (22% while we're doing Roth conversions) and IRMAA thresholds along with CGs. I've updated/repeated every year. Quite a few moving parts - [-]wages[/-], dividends (qualified & not), exempt income, treasury interest, STCG, LTCG, cash interest, Roth conversions, TIRA distributions, estimated payment (Fed & state). And there will be even more when we start SS in 2024 & 2026. Much easier to let a spreadsheet figure it all out.

I also run my numbers through https://www.dinkytown.net/java/1040-tax-calculator.html a couple times a year for a second opinion - but one could just use that alone. Great resource IMO.

Last edited:

jayanu

Recycles dryer sheets

I’ve been using Fidelity Retirement Planner for years - never saw a tax estimate. How do you display taxes?

Fidelity's ePlanner includes that. But ePlanner is to be run by Fidelity expert unlike old Retirement IncomePlanner. You give input and Fid rep will do the simulation and give the results.

Al18

Full time employment: Posting here.

I spoke with a Fidelity Financial Consultant and he confirmed that on the Fidelity Retirement Analysis report, the expense dollar amount for the 3 modeling % was a NET dollar amount.

I spoke with a Fidelity Financial Consultant and he confirmed that on the Fidelity Retirement Analysis report, the expense dollar amount for the 3 modeling % was a NET dollar amount.

So, the expense dollar amount does not include taxes? Is that correct?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I spoke with a Fidelity Financial Consultant and he confirmed that on the Fidelity Retirement Analysis report, the expense dollar amount for the 3 modeling % was a NET dollar amount.

Net as in it did not include taxes? If so, he is wrong. It’s spelled out in the methodology linked in the tool how it goes about estimating taxes, but also shows assumptions in detail with a caveat that it shouldn’t be used as a precise tax tool because of all the potential moving parts.

Further evidence of it including taxes is just the math. When I look at my yearly withdrawal, it is about $10,000 higher than my total expenses as detailed in the budget area. That difference is the tax estimation.

Last edited:

Al18

Full time employment: Posting here.

I read the notes about taxes in the appendix and reviewed the dollar amounts in the spending plan and I think COcheesehead is correct. The yearly expenses INCLUDE taxes. So if want to spend $78,000 per year, you need to add your estimated taxes to your spend amount. For married filing jointly, this would be about 7% federal taxes, so you would tell the program you're expenses are $83870 yearly.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I read the notes about taxes in the appendix and reviewed the dollar amounts in the spending plan and I think COcheesehead is correct. The yearly expenses INCLUDE taxes. So if want to spend $78,000 per year, you need to add your estimated taxes to your spend amount. For married filing jointly, this would be about 7% federal taxes, so you would tell the program you're expenses are $83870 yearly.

You don’t have to add in taxes. Just create a budget in the spending module and the tool will generate the tax for you. That is why you are asked for filing info and state taxation in the tax module.

If you use FireCalc, you have to add taxes to your yearly spend.

qwerty3656

Full time employment: Posting here.

- Joined

- Nov 17, 2020

- Messages

- 762

You don’t have to add in taxes. Just create a budget in the spending module and the tool will generate the tax for you. That is why you are asked for filing info and state taxation in the tax module.

If you use FireCalc, you have to add taxes to your yearly spend.

Does it show what the tax is anywhere? Most of my money is in a Roth and it wasn't clear to me whether it was assuming I was paying taxes on the withdrawal.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Does it show what the tax is anywhere? Most of my money is in a Roth and it wasn't clear to me whether it was assuming I was paying taxes on the withdrawal.

Go into the methodology PDF which is linked in the tool. They go into great detail on tax assumptions by account type. The goal of the tool is to get you in the ballpark because there are too many individual variances. For me, the tax is likely over estimated, but better that than underestimated.

Last edited:

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Does it show what the tax is anywhere? Most of my money is in a Roth and it wasn't clear to me whether it was assuming I was paying taxes on the withdrawal.

You're curiosity is in the right place.

Having a reasonably accurate estimate of your future taxes is critical for retirement budgeting. Either fully understand how Fidelity is doing the tax estimate or use some other tax forecasting tool and understand the inputs and outputs. Or pay a CPA to do it for you.

I'm mystified when folks talk about how accurately they track current spending and how they research how spending might vary going forward. But, they then go on to have future taxes be just a shot in the dark guess. In our case fed + state taxes = about one third of our total spending so it is/was key to have a good estimator going forward.

- Joined

- Apr 14, 2006

- Messages

- 23,103

I agree with you that getting a handle on your taxes is very important. But you don't need an estimator program. All the instructions and forms are online. Just calculate your taxes by hand, change whatever numbers you want and do them again to see what happens. That's what I do.You're curiosity is in the right place.

Having a reasonably accurate estimate of your future taxes is critical for retirement budgeting. Either fully understand how Fidelity is doing the tax estimate or use some other tax forecasting tool and understand the inputs and outputs. Or pay a CPA to do it for you.

I'm mystified when folks talk about how accurately they track current spending and how they research how spending might vary going forward. But, they then go on to have future taxes be just a shot in the dark guess. In our case fed + state taxes = about one third of our total spending so it is/was key to have a good estimator going forward.

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I agree with you that getting a handle on your taxes is very important. But you don't need an estimator program. All the instructions and forms are online. Just calculate your taxes by hand, change whatever numbers you want and do them again to see what happens. That's what I do.

Sure. I do that too. Or I just open last year's TurboTax and change numbers as per my guess of what they'll be in the future.

Al18

Full time employment: Posting here.

The Fidelity Retirement Planner is just a calculator that will project your expenses and balances over your lifetime. It does not calculate your taxes, or give you any guidance if you should be doing Roth IRA conversions or any other tax planning strategy.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The Fidelity Retirement Planner is just a calculator that will project your expenses and balances over your lifetime. It does not calculate your taxes, or give you any guidance if you should be doing Roth IRA conversions or any other tax planning strategy.

It includes a tax estimate in your expenses.

I use Dinkytown’s 1040 tool to estimate taxes.

There are Roth conversions tools as well.

Al18

Full time employment: Posting here.

Correction - the FRP does show RMD amounts, so with this info the user is left to determine if RothIRA conversions are needed.

Al18

Full time employment: Posting here.

No, it does not show a tax estimate in your expenses. I checked again today.

Similar threads

- Replies

- 0

- Views

- 218