I'm 54, have had a good career and built up a decent net worth. FireCalc and NewRetirement say I can retire and be in good shape 99%. But....I am a very conservative investor. Portfolio is roughly 45% bonds (pretty short term, with almost half maturing over next year), 15% preferred stocks (including half that have maturities in 3-5 years), 10% common equities, 15% cash/money market, and 15% real estate (rental property). I am educated, MBA in finance, have worked in the investment industry for 25+ years. I know all the statistics and strategies on equities, asset allocation, historical returns, etc.

But.... I just cannot hold a big allocation to equities. I fundamentally don't trust the people running the country (or states or locals, for that matter), don't trust the Fed, etc. Maybe "don't trust" is not the best word, a better description is that I believe they are all incompetent, or the system is so entrenched that its impossible to make any real change. (This is not political, it seems to be the case no matter which party is in power.) [Mod Edit]

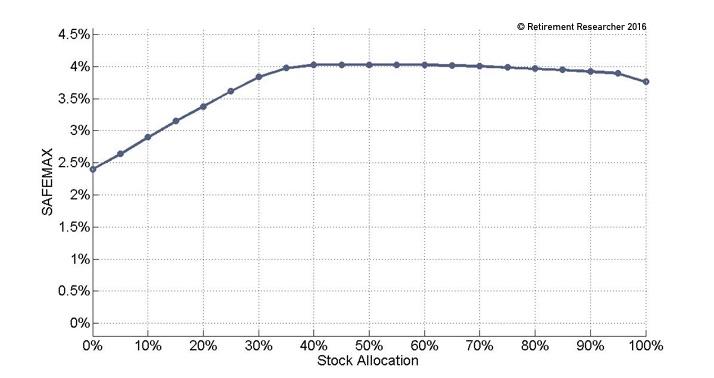

Curious as to other people feel like this? How do you hold 60% equities in this kind of world and sleep? Like I said, I know that long term historical returns, etc etc etc. but it seems very likely the next 30 years are going to be very different from the last 30 years. Am i wrong? Do I need a therapist? What am I missing? Or do we just hold our nose and invest in 60/40 because that has worked for the last 30 years?

But.... I just cannot hold a big allocation to equities. I fundamentally don't trust the people running the country (or states or locals, for that matter), don't trust the Fed, etc. Maybe "don't trust" is not the best word, a better description is that I believe they are all incompetent, or the system is so entrenched that its impossible to make any real change. (This is not political, it seems to be the case no matter which party is in power.) [Mod Edit]

Curious as to other people feel like this? How do you hold 60% equities in this kind of world and sleep? Like I said, I know that long term historical returns, etc etc etc. but it seems very likely the next 30 years are going to be very different from the last 30 years. Am i wrong? Do I need a therapist? What am I missing? Or do we just hold our nose and invest in 60/40 because that has worked for the last 30 years?

Last edited by a moderator: