$10k @ 4% x 30 yrs. = $583,283 - 25% taxes = 437,462

$7.5k @ 5.75% x 30yrs.= $600,114 - 15%LT tax= 510,097

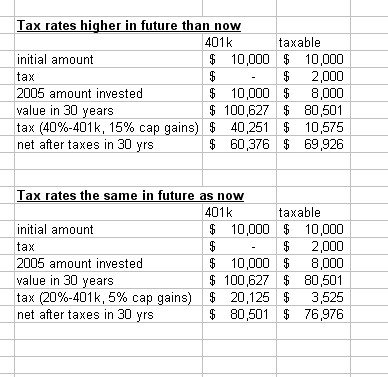

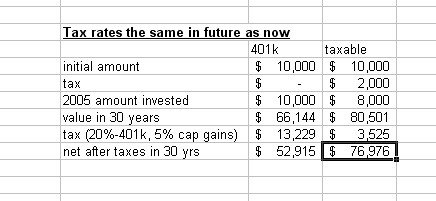

This i found on another site, but it relates. The first is a 401k with 2% expense ratio. The second is a taxable account with a .25% ratio. Both assume the same 6% overall eprformance.

Even though the second is taxed 2x, it's more efficient by far. This is assuming at the beginning that the person is int he 25% bracket. Being in the 15% bracket puts the taxable, second option, way ahead of the game!

I'll have to re-calculate assuming my specific scenario, 1.5% Expense ratio, and 15% tax bracket to see...

EDIT: assuming the 401k earned 6%, had a 1.5% Expense ratio, and you contributed 10k pre-tax money yearly for 30 yrs, after a 25% tax in 30 yrs you'd be at 477k, 541k if taxed at 15%

Assuming .3 ER on the taxable account leaves 572k, assumign a 15% capital gains tax

ADVATNAGE: TAXABLE by either 95k, or 30k

summary:

401k

10k/yr, for 30 yrs @ 4.5%=637k minus 25% tax=477k, 15% tax=541k

Taxable

8500/yr, for 30 yrs @ 5.7%=673k minus 15% cap gains=572k , @ 5% cap gains=640k!!

25% bracket: 7500/yr @5.7%=594k minus 15% cap gains= 505k, 5% cap gains =564k.

SO, if you are 15% now, taxable wins hands down

If you are 25% now, and end up in 25% bracket, taxable wins by 28k

If you are 25% now, and end up in 15% bracket, taxable wins by 13k

Is my math flawed?