pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's actually insurance!! Let's see if you would like your health Insurance premiums taxed in the same way?

"The Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.

But it isn't health insurance... it is a a life pension, life insurance and disability insurance combined. For pension-type annuities the portion representing the growth is taxed and the contributions are not taxed.

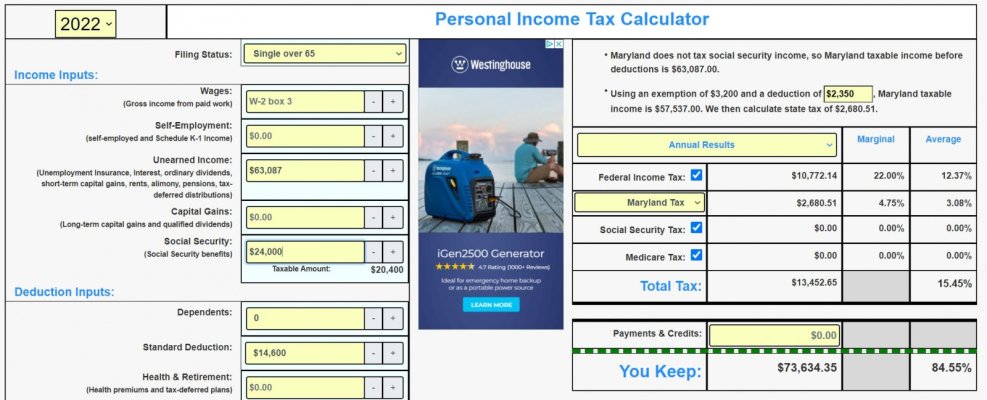

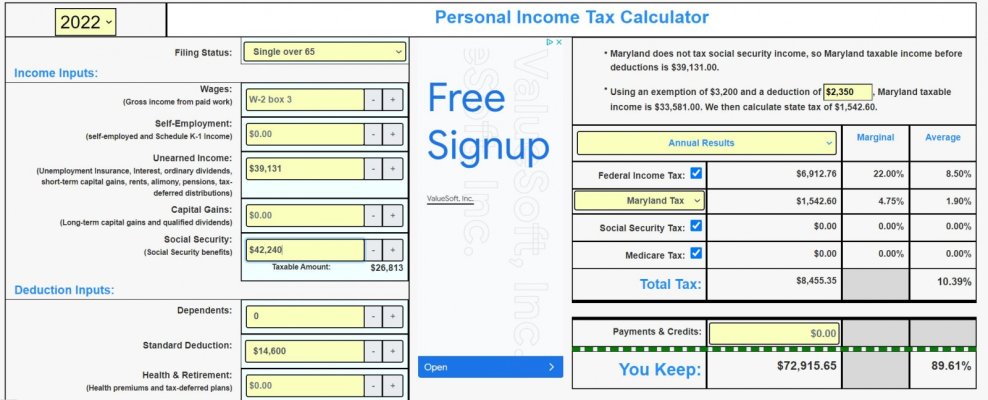

If I claim at 70 and calculate the exclusion ratio as if my SS was a life annuity using 75% of what I paid in SS taxes per my SS statement (assumes that 75% was for retirement benefits and 25% for DI and survivor insurance) then I get a 13.8% exclusion ratio, meaning that 13.8% of my benefits would not be taxed and 86.2% would be... interesting coincidence that it is so close to 85%, eh?

IOW,

............... 75% of SS paid per my SS statement..............

(age 70 benefit * 12 mos/year * 14 year life per IRS table) = 13.8%

Last edited: