wanaberetiree

Full time employment: Posting here.

- Joined

- Apr 20, 2010

- Messages

- 718

Hi all

I know many tax experts are here, so here is my dilemma.

I still do an LLC (California) that brings ~0-20K in income.

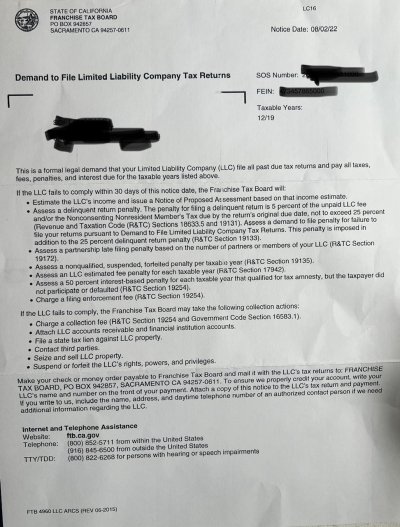

All of a sudden I got a letter from the California Franchise Board - Demand to file limited liability company tax returns

What do they want and what I need to provide?

Thx

I know many tax experts are here, so here is my dilemma.

I still do an LLC (California) that brings ~0-20K in income.

All of a sudden I got a letter from the California Franchise Board - Demand to file limited liability company tax returns

What do they want and what I need to provide?

Thx